Silk Road 1: Theory & Practice

History, background, visiting, ordering, using, & analyzing the drug market Silk Road 1

- Size

- Competitors

- Cypherpunks

- Bitcoin

- Silk Road As Cyphernomicon’s Black Markets

- Silk Road As a Marketplace

- Preparations

- Silk Road

- Legal Wares

- Anonymity

- Shopping

- LSD Case Study

- Finis

- Future Developments

- Post-Mortem

- See Also

- External Links

- Colophon

- Appendices

The cypherpunk movement laid the ideological roots of Bitcoin and the online drug market Silk Road; balancing previous emphasis on cryptography, I emphasize the non-cryptographic market aspects of Silk Road which is rooted in cypherpunk economic reasoning, and give a fully detailed account of how a buyer might use market information to rationally buy, and finish by discussing strengths and weaknesses of Silk Road, and what future developments are predicted by cypherpunk ideas.

The website Silk Road 1 (SR1), a drug marketplace operating in public, needs little introduction at this point, after Gawker’s 201115ya article went viral, drawing fire from the likes of US federal Senators Schumer & Manchin. It was probably the single most famous commercial enterprise using Bitcoins; some speculated that demand from SR patrons single-handedly pushed the exchange rate up by $5 the weekend of the Gawker article. It then flourished until its bust in 2013-10-02.

Size

Estimates of SR’s size have been done several ways: most purchases entail a review at the end, and reviews are displayed on the front page, so one can monitor the front page and extrapolate to estimate average number of transactions per day or week, and from there estimate turnover and what SR’s commissions total to: eg. ~100 transactions a day over 2 years and averaging ~$150 is . “Traveling the Silk Road: A measurement analysis of a large anonymous online marketplace” (2013) spidered Silk Road for 8 months (2011–2012) and did something similar by recording all public prices, feedback indicating how much had been sold, and calculating a monthly turnover of $1.2m for annual revenue of ~$15m; the difference in estimates seems explained by my estimate of daily transactions being considerably too low.1 The DHS in November 2013 estimated Mt. Gox alone “was moving approximately $60 million per month into a number of Internet-based hidden black markets operating on the Tor network, including Silk Road” around the time of Gox seizures in May 201313ya, although this turnover seems too high given other monthly estimates.

Another way is to look in the blockchain for SR-related addresses or transactions; one possible address had a 2012-06-23 balance of ₿450,825 or $2,885,280. Since it is unlikely there are ~$3m of transactions active or sitting in wallets that day on SR when the largest previous Silk Road scammer (Tony76)—pulling out all the stops—got away with an order of magnitude less money, this is highly likely to represent Silk Road’s profits or profits plus balances & escrows; which at a commission of 5-10% implies a total Silk Road turnover of >$28m. Interestingly, 2013’s analysis concluded that Silk Road was by July 2012 receiving $92k monthly or $1.7m yearly in commissions (and twice that yearly figure is larger than that address balance—as it should be, being an upper bound). On 2013-04-09, a single transaction of ₿69471 was made by the address 1BAD...GuYZ, and may have been related to the SR cointumbler. For further discussion, see “A Fistful of Bitcoins: Characterizing Payments Among Men with No Names”, et al 2013.

Competitors

I know of one competing English Bitcoin+Tor marketplace as of 2011-06-09, named BlackMarket Reloaded which lives at 5onwnspjvuk7cwvk.onion (non-Tor mirror); informed 201115ya opinion seemed to be that it is low-volume and stagnant, but it apparently has improved substantially and as of February 201313ya, has grown substantially with ~$700k monthly turnover and begun to rival SR; with the fall of SR, it attracted substantially more attention, some of which extracted the site’s source code and copied its database, leading BMR to shut down temporarily in 2013-10-17.2 A third rival, Atlantis (atlantisrky4es5q.onion; mirror) was launched 2013-03-14 and has reportedly turned over >$500k between March and June 2013; it had a much more appealing glossy Web-2.0 look than the SR’s relatively old design, but made some questionable choices like providing “convenient” in-browser encryption and using Litecoin rather than Bitcoin. Atlantis shut down in September 2013, after telling DPR1 that “they shut down because of an FBI doc leaked to them detailing vulnerabilities in Tor.” The main rival to BMR was a small new site which started up in early 201313ya, called Sheep Marketplace (sheep5u64fi457aw.onion), which in late November 201313ya halted withdrawals, top vendors began scamming users, and Sheep essentially shut down 2013-11-29 after exfiltrating >₿39,644 & apparently selling some on BTC-E. Finally, there was a “Deepbay” (deepbay4xr3sw2va.onion), apparently started in early 201313ya as well and going public in June; little has been said about it and its security is unknown, but it reportedly stole all user bitcoins starting somewhere around 2013-11-04.

There are 2 Russian competitors, “RAMP” & “Shop of Magic Products” (Wired; short interview), which have been compared to SR and BMR (respectively).

Cypherpunks

Neither Bitcoin nor the Silk Road should be understood outside their ideological and historical context: the now-obscure cypherpunk movement.

The “cypherpunk” group was a loose affiliation of cryptographic researchers and enthusiasts centered on the eponymous email list in the 1980s and 1990s who developed many novel ideas and approaches to communication, economics, and politics. Achievements of theirs included developing anonymous email remailers (inspiring the Tor anonymizing network), helping defeat the Clinton-era Clipper chip and setting a key precedent, and helping defeat USA export restrictions on cryptography (key to safe Internet commerce outside the USA; the costs of export restrictions can be seen to this day in South Korea, which locked itself into a Microsoft/Internet Explorer computer monoculture). No event marked their dissolution, but through the ’90s, they gradually lost cohesion and interest as various ideas were successful and others remained barren. (Timothy C. May remarked in 199432ya that an acceptable digital currency may take several years to develop, but that he had been that optimistic years before as well; we could date the fulfillment of the dream to Bitcoin—14 years later—in 200818ya.) Former cypherpunks include large corporations to technological innovation (BitTorrent, descending from MojoNation) to niche groups like transhumanism (digital currency inventor Wei Dai) to activism (EFF, Julian Assange’s WikiLeaks) etc.

The cypherpunk paradigm can be summarized as: “replacing centralized systems of interactions enforced by coercion with decentralized systems of voluntary interaction whose rules are enforced by mathematics/economics”. Desiderata for systems include: communications private from all third-parties, anonymous, provably untampered with, and provably from particular parties; social mechanisms like reputation replaced by formalized systems like feedback; and legal mechanisms like anti-fraud statutes superseded by mechanisms such as escrow or bonds (which can be fortified by cryptographic techniques as multiple-party signatures).

The ideal cypherpunk system is self-enforcing, self-regulating, and cannot be attacked directly by outsiders because they do not know where it is or how to affect it.

Julian et al 2012 write:

The new world of the internet, abstracted from the old world of brute atoms, longed for independence. But states and their friends moved to control our new world – by controlling its physical underpinnings. The state, like an army around an oil well, or a customs agent extracting bribes at the border, would soon learn to leverage its control of physical space to gain control over our platonic realm. It would prevent the independence we had dreamed of, and then, squatting on fiber optic lines and around satellite ground stations, it would go on to mass intercept the information flow of our new world – its very essence even as every human, economic, and political relationship embraced it. The state would leech into the veins and arteries of our new societies, gobbling up every relationship expressed or communicated, every web page read, every message sent and every thought googled, and then store this knowledge, billions of interceptions a day, undreamed of power, in vast top secret warehouses, forever. It would go on to mine and mine again this treasure, the collective private intellectual output of humanity, with ever more sophisticated search and pattern finding algorithms, enriching the treasure and maximizing the power imbalance between interceptors and the world of interceptees. And then the state would reflect what it had learned back into the physical world, to start wars, to target drones, to manipulate UN committees and trade deals, and to do favors for its vast connected network of industries, insiders and cronies.

But we discovered something. Our one hope against total domination. A hope that with courage, insight and solidarity we could use to resist. A strange property of the physical universe that we live in. The universe believes in encryption. It is easier to encrypt information than it is to decrypt it. We saw we could use this strange property to create the laws of a new world. To abstract away our new platonic realm from its base underpinnings of satellites, undersea cables and their controllers. To fortify our space behind a cryptographic veil. To create new lands barred to those who control physical reality, because to follow us into them would require infinite resources. And in this manner to declare independence.

The decentralization is key. Centralization is unacceptable for many applications: centralization means any commercial or political interest can interfere for any purpose, be it rent-seeking or taxation, prosecuting economic warfare against another party, intended to hamper organized crime or terrorism, etc.

This fear of centralization is not idle. The ring of power offered by centralization has been grasped on many occasions: ranging from Paypal hampering its competitors to US-led crackdowns on ancient hawala financial systems & Islamic charities in the name of counter-terrorism to the US suing the Intrade prediction market (with the assistance of the Central Bank of Ireland) to credit card companies’ near-fatal boycott of WikiLeaks to Iran’s severe inflation after economic embargoes. Previous centralized digital currencies like E-gold or Liberty Reserve suffered the expected fates, and more pointedly, an earlier online drug market (the “Farmer’s Market”) was shut down and principals indicted using scores of transaction details stored by banks & Paypal & Western Union.

Bitcoin

The fundamental challenge confronting any electronic currency is coping with the “double-spend problem”: when transactions conflict (eg. spending twice the same unit of currency), which transaction takes priority? Double-spends are difficult to perform with non-electronic money since you cannot give a dollar bill to one person while simultaneously giving it to another, but trivial with electronic messages.

One solution is to centralize transactions: if you overdraw your bank account with 2 checks, the bank will choose one to bounce and one to honor. Similarly for credit card transactions. An electronic currency like Paypal processes each transaction in realtime, so you cannot log into your Paypal account in 2 browsers and send your entire balance to 2 different people. With centralization, there is someone or something which ‘decides’ which of the 2 conflicting transactions will become the real transaction. Centralization appears in many guises in currency systems: cryptographic pioneer David Chaum’s own electronic currency could guarantee complete anonymity to anyone “spending” a coin, solving the double-spend problem by devising things so that a double-spend leaks enough information that the anonymity evaporates, but the math only works with a central “bank” which could be attacked. Chaum’s system never took off, for several reasons, but this centralized point of failure is one.

If we avoid the problems of centralization and resolve on a decentralized system, we face a different but equally severe set of problems: without centralization, in a distributed system in which no party has veto power (and any party can be anonymous or a mask for another party), how and who decides which of 2 conflicting transactions is the “real” transaction? Must a distributed system simply allow double-spends, and thus be useless as money?

No. The underappreciated genius of Bitcoin is that it says that the valid transaction is simply “the one which had the most computing power invested in producing it”. Why does this work? In the Bitcoin distributed system, there are many ‘good’ parties at work producing new transactions, and they will independently latch onto one of the two competing transactions produced by an attacker and incorporate it into future transactions; the amount of computing power necessary to out-invest those other parties quickly becomes too enormous for any one entity to invest. Within hours, one transaction will be universal, and the other forgotten.

Hence, Bitcoin is an acceptable cypherpunk currency: it is decentralized, parties participate out of self-interest, and it is economically infeasible to attack Bitcoin directly.

Silk Road As Cyphernomicon’s Black Markets

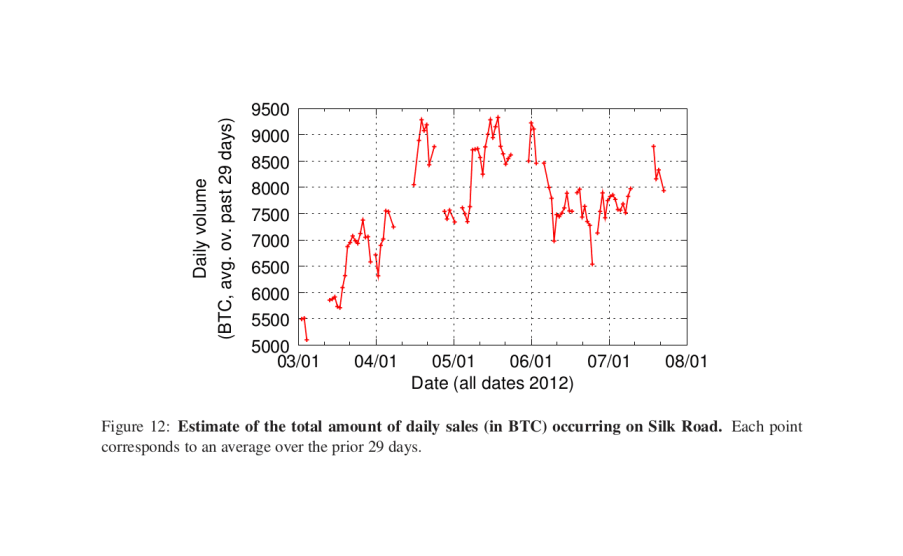

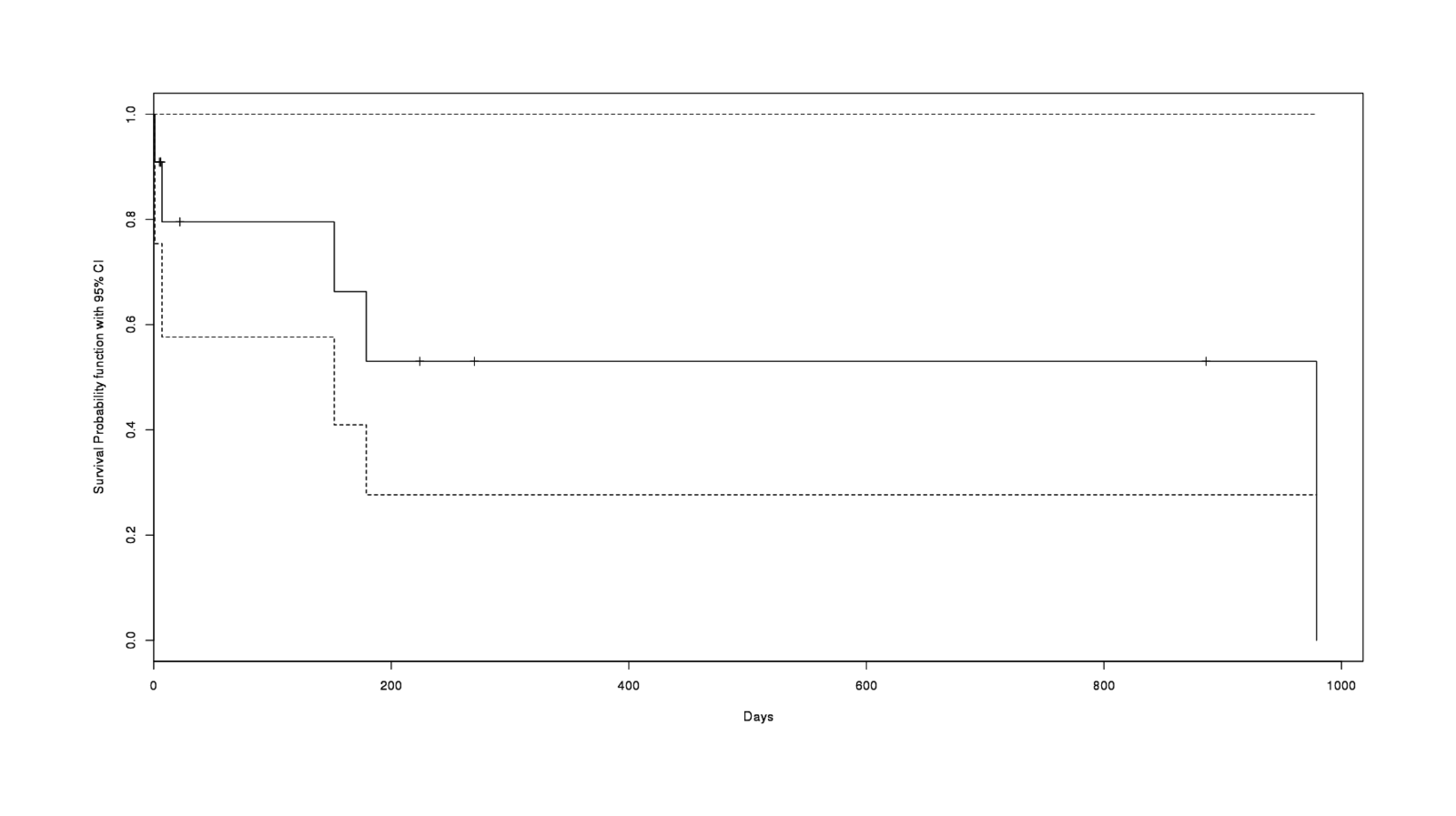

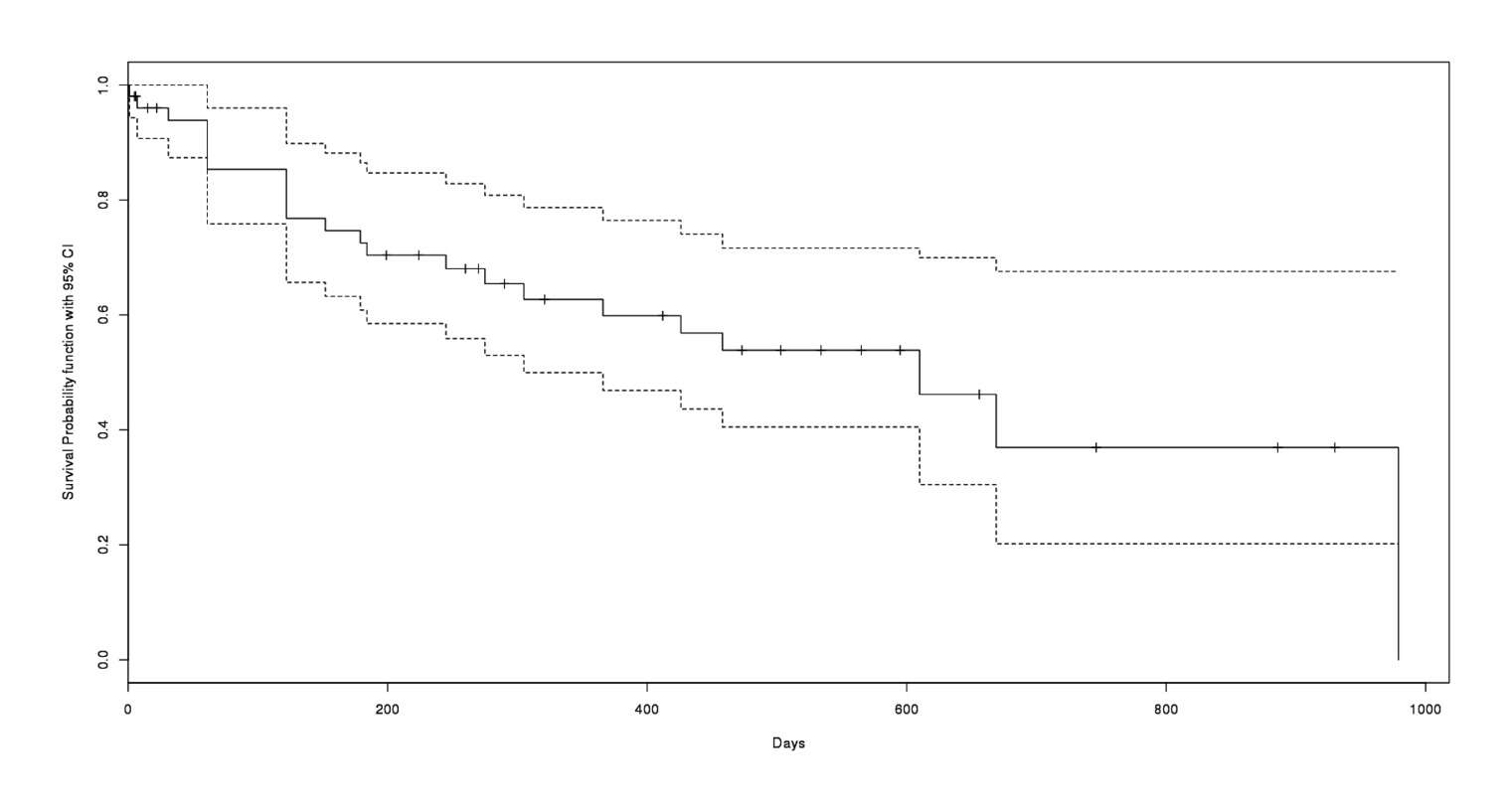

The Silk Road (SR) is a website accessible through the Tor anonymizing network. Tor is descended from cypherpunk designs for anonymous email: messages are swapped by servers in the “mix” network with changing cryptographic wrappers, so observers cannot tell what server a message ultimately ends up at nor who sent a message. Buyers create accounts, send bitcoins to SR-controlled addresses, browse seller pages, and order quantities similar to any e-commerce site. (Contrary to descriptions of SR as “the eBay of drugs”, SR is more akin to shopping on Amazon Marketplaces than eBay: there are no auction features.) SR has been covered in the media for years and is still operating successfully, indeed, 2013 calculated a monthly turnover of ~$1.2m for annual revenue of ~$15m from 2011–2012, with daily sales volume:

“Figure 12: Estimate of the total amount of daily sales (in ₿) occurring on SR. Each point corresponds to an average over the prior thirty days.” –2013

The design of SR could be taken straight out of early ’90s cypherpunk—most of the design can be justified in Timothy C. 1994 Cyphernomicon, itself mostly a summary of much earlier discussions. (In an amusing historical coincidence, May happens to mention an old digital currency proposal called… “The Digital Silk Road”.) The SR is an unregulated black marketplace which is:

reached via an anonymizing mix network

made up of pseudonymous entities, who

communicate privately and securely via public-key cryptography to arrange purchases

using escrow schemes for payment of sellers only on receipt of goods

said sellers post the equivalent of bonds as surety before being allowed to sell

and buyers publicly rate their sellers (so the marketplace avoids becoming a lemon market)

From an economic point of view, several measures serve to make incentives align:

SR is paid as a percentage of transactions; hence, it is motivated to encourage as high a turnover as possible, and maintain the satisfaction of both buyers and sellers. This makes SR a relatively trustworthy agent because too much abuse will cause buyers or sellers to leave and cease paying the percentage, especially if there are any competing marketplaces. (This is the same dynamic that kept users on Liberty Reserve before it was shut down.)

Sellers are encouraged to not scam buyers because they will not gain access to bitcoins in escrow and enough violations will forfeit their deposit held by SR

Buyers have limited incentive to scam sellers because their bitcoins are paid in advance and not under their control; SR arbitrates disputes and more than a few bad transactions can lead to their balances forfeited and being blacklisted, limiting their ability to scam large amounts

And as far as people outside the marketplace are concerned, there is a network effect at play: the better incentives align, the more buyer and sellers there will be, and they will lead to better selections and lower prices. All familiar economic results about normal thick commodity markets, but perhaps unexpected to see in such an exotic marketplace.

Escrow

One aspect of the incentives deserves coverage as most presciently discussed by the cypherpunks and underappreciated by users: the use of escrow.

Timothy C. May’s chapter 12 (“Legal Issues: Loose Ends: Escrow Agents”) lays out the necessity of escrow when a marketplace uses both pseudonymity and untraceable digital cash:

On-line clearing has the possible danger implicit in all trades that Alice will hand over the money, Bob will verify that it has cleared into his account (in older terms, Bob would await word that his Swiss bank account has just been credited), and then Bob will fail to complete his end of the bargain. If the transaction is truly anonymous, over computer lines, then of course Bob just hangs up his modem and the connection is broken. This situation is as old as time, and has always involved protocols in which trust, repeat business, etc., are factors. Or escrow agents.

…In steps “Esther’s Escrow Service.” She is also untraceable, but has established a digitally-signed presence and a good reputation for fairness. Her business is in being an escrow agent, like a bonding agency, not in “burning” either party. (The math of this is interesting: as long as the profits to be gained from any small set of transactions is less than her “reputation capital,” it is in her interest to forego the profits from burning and be honest. It is also possible to arrange that Esther cannot profit from burning either Alice or Bob or both of them, eg. by suitably encrypting the escrowed stuff.) Alice can put her part of the transaction into escrow with Esther, Bob can do the same, and then Esther can release the items to the parties when conditions are met, when both parties agree, when adjudication of some sort occurs, etc. (There a dozen issues here, of course, about how disputes are settled, about how parties satisfy themselves that Esther has the items she says she has, etc.)

“Esther” is SR, “on-line clearing” is bitcoins, Alice is a buyer and Bob the seller, but otherwise the logic is clear and unmistakable: lack of escrow leads to a perverse incentive for Bob to scam Alice.

We can see the proof in practice. For various reasons, SR provides buyers the option of releasing their funds from escrow to the seller, called “early finalization”; early finalization is one of the leading mechanisms for seller scams on SR. The cardinal example is the April 2012 scam where a trusted seller took the occasion of a SR-wide sales event (where SR waived its fees) to announce unusually low prices, took in hundreds of large orders totaling thousands of bitcoins (the equivalent of >$50,000) but requiring early finalization, withdrew all funds, and never delivered. A simple enough scam, yet highly effective: as May and other cypherpunks pointed out decades before, one should never entrust a pseudonymous agent with more liquid anonymous cash than its “reputation capital” is worth! One can entrust the agent with less liquid anonymous cash (not enough to burn one’s reputation in exchange for), or one could entrust the agent with more escrowed anonymous cash (so they cannot “rip-and-run”), but not both more and un-escrowed (which is paying them to scam you).

(This could be helped slightly by providing more information about sellers, like listing the outstanding balance for sellers so buyers can be wary of any seller with an unusually large outstanding balance; but buyers will still be attracted by sales as excuses for finalizing early, and sellers could simply split their activity over multiple accounts. Escrow remains the best solution.)

Silk Road As a Marketplace

“Silk Road doesn’t really sell drugs. It sells insurance and financial products,” says Carnegie Mellon computer engineering professor Nicolas Christin. “It doesn’t really matter whether you’re selling T-shirts or cocaine. The business model is to commoditize security.”3

Beyond the basic cryptographic tools and features of the site itself, SR embodies the cypherpunk dream of letting free-market forces operate to inform buyers and let them find sellers with whom they can reach mutually acceptable agreements. There is no better way to demonstrate this dynamic than with a detailed example using real SR data of a hypothetical buyer compiling the information SR provides, making inferences on the provided data, applying his desires to appraise each seller’s wares, trading off various criteria such as risk versus price, and finally settling on a particular product.

But one wonders: what is using it like? Does it have a decent selection? Is it safe? Ridden with scammers? Has it succumbed to an Eternal September (“I used SR when it was still underground”)? Shouldn’t we keep quiet about it like Fight Club?

Quality

The purity and safety of SR wares, while varying considerably from seller to seller, batch to batch, and drug to drug, seems to have generally been high. For example, the LSD Avengers’ lab testing kept the LSD section’s quality up, and the FBI in its JTAN search warrant request did its own lab testing:

Since November of 201115ya, law enforcement agents participating in this investigation have made over 70 individual purchases of controlled substances from various vendors on the Silk Road Underground Website. The substances purchased have been various Schedule I and II drugs, including ecstasy, cocaine, heroin, LSD, and others. As of April 201313ya, at least 56 samples of these purchases have been laboratory-tested, and, of these, 54 have shown high purity levels of the drug the item was advertised to be on Silk Road.

Successful delivery rates of real drugs were high; the DHS agent Jared Deryeghiayan reportedly testified that of >50 orders, “All but 1-2 shipped the advertised drug.”

Subsequent DNMs likewise appear to have high purities on average. For example, the Spanish drug testing service Energy Control found as of March 201511ya that “Users are asked about the type of substance they believe they have purchased. In 120 of 129 samples (93%), the main result of the analysis was consistent with the information provided by the user”4

Safe

The safety of using Tor darknet markets is a major question (and worries about safety are, according to et al 2013’s survey analysis, a major reason people don’t use SR), and one I find interesting. Unsurprisingly, it’s hard to find solid information on how many people have been busted using SR or what happened to them, and the consequences will depend on the specific substance and amounts. For example, modafinil seems to be de facto not prosecuted in the US, and the failure rates of importing from online pharmacies seem to be in the <10% range according to buyer anecdotes and 1 seller. Some users report occasional interceptions like when Forbes ordered 3 items in 2013 & 1 failed to arrive, but others claim flawless delivery records (even someone claiming to buy $50k of opiates a year on SR). General descriptions of drug importation also suggest low interception rates (as makes sense given the very large quantities of drugs sold every day); the large Canadian LSD seller Tessellated estimated in July 201313ya that “less than 1% of our packages are reported missing (some of this may be customers lying)” and 2 English drug journalists in December 201214ya discussing their most recent book:

Q: “How much of the drugs that enter the country are actually seized by police?”

A: “I think the figure that’s quoted in our book is about 1%; it really is a fraction of what gets in. There was one conversation I had with a chap who had access to the Serious Organised Crime Agency who said that if people knew how easy it was, then more people would do it.”

Buyers and sellers seem to be treated differently as well: in the 201214ya bust of the insecure Farmer’s Market (see later footnote), the indictment only lists sellers and no buyers.

Arrests

Due to length, this section has been split out as a separate page.

LE Reports

Security-wise, SR seems to be receiving passing grades from law enforcement agencies internally; a leaked FBI report mentioned no attacks against SR, an anonymous federal source reports frustration5 (although these sources may just be echoing public information6), anonymous anecdotes claim the DEA is stymied7, while a May 201214ya Australian document reportedly praised the security of seller packaging and general site security, with a pseudonymous SR forums user claiming to summarize it:

Recently, I gained access to an internal confidential report distributed to several Australia LE agencies and a few international anti-narcotic bodies regarding possible methods of combating illegal activities involving BC. Of course SR was a main feature of said report…So here are the nuts and bolts of the report, spread the information as far and wide as possible friends:

PGP is terrifying them, every new user who learns it and helps others learn, closes a possible loophole they were planning to exploit.

User ignorance of the technology being used (Tor, PGP etc.) is their single best hope for any kind of serious action against the SR community.

Narcotic trade historically involves exploitation and violence. Users working together as a community for a greater good and towards the same goals has made all previous interdiction training basically obsolete. In other words, every user who helps newcomers learn how to be safe and secure especially through the use of PGP for all transactions and communication is a nail in LEO’s coffin.

A total lack of violence and exploitation is very much working in our favor. So in other words, the idea of a community working together to protect the new and vulnerable has been identified as a huge obstacle for any kind of serious attempt to stop SR.

Their morale regarding fighting SR and BC is very low at the moment, mainly because very few LEO have the capacity to comprehend how the whole system works, but unfortunately, recent media coverage demands some kind of action, so they are going to have to show the public they are doing something to combat SR, they just aren’t sure what yet.

Vulnerabilities

In particular, I am impressed that after years of operation as of April 201313ya, SR seems to have never been seriously hacked or broken into: in that time, there have been many hacks of other sites and >9 hacks of Bitcoin currency exchanges. There has been a perennial forum spam problem, and in late 201214ya, there was a SQL injection attack leading to images being corrupted with false addresses and a few people losing their money by not being suspicious, but that seems to be it. And SR is the biggest target out there besides MtGox, for multiple reasons—the sheer amounts that pass through it, the potential of it being a small team rather than a professional group (how do you hire penetration testers when you’re SR?), the unusual products you can order, the notoriety one would earn, and finally, the “lulz” value of their databases (suppose someone were able to harvest addresses & names that are foolishly sent to sellers in the clear & unencrypted; imagine the lulz value of releasing them all in a big dump! People would be wetting their pants worldwide, since despite all warnings, there are always a great number of users who will not bother encrypting their addresses.)

My belief is that SR can be taken down; however, I am not sure LE (law enforcement) has permission to use the tactics necessary—explaining the lack of suggested attacks or realistic attacks in the leaked FBI Bitcoin paper and summaries of the leaked Australian SR paper (respectively). My two suggested attacks are

DDoSing the SR site, rendering it unusable (and congesting the overall Tor network)

fake buyer & seller accounts leading up to a single large scam.

Attack #1 would make the site simply unusable, and can be done on any address SR runs on since the address has to be widely known or how will the buyers & sellers know where to go? This would require a few dozen nodes, at least, although I’m not actually sure how hard it is to DDoS a Tor hidden server—reportedly the DDoS which took down SR for weeks was being run by a single individual in their spare time8, and by the very nature of the Tor anonymizing network, it should be difficult to do anything at all about a DoS attack since how do you identify the end-nodes responsible, as opposed to the relays passing on their messages? And the obvious counter-measure, running through many .onion addresses, even one for every user, would substantially reduce the actual anonymity of the SR servers. That a weak DDoS attack was already so successful against SR raises serious doubts in my mind about the ability of hidden services to resist a real DDoS attack like by a medium-sized botnet.

Attack #2 would require a fairly substantial financial investment to pay the ~$500 deposit required of each seller account, but depending on how effective the final step is, may actually run at a profit: it’s not hard to get $500 of orders at any time, since you can build up a reputation, and then when you decide to burn the account, you can solicit orders for weeks due to shipping delays, and then delay the resolution even longer. Certainly the many FE scammers like Tony76, who have made off with hundreds of thousands of dollars, have demonstrated that this is perfectly doable and claims to the contrary are wishful thinking; and certainly LE is patient enough to do this tactic since it’s exactly what they did with Farmer’s Market & carder.su & other forums/sites too obscure to be remembered. Repeated, this would massively destroy buyers’ trust in SR, especially since there are usually only a few hundred active sellers at any point. (pine, commenting on how the competing darknet market Atlantis did in-browser encryption which I criticized as security theater & Hushmail redux, points out the Eternal September version of this scenario: the more newbie buyers who are too lazy or arrogant to use PGP (~90% of users, according to the Atlantis administrators in June 201313ya; >50%, according to a former SR1 seller; >30% of Sheep Marketplace users according to the seller “haydenP” on 2013-11-22; DPR2 estimated “between 8% and 12%” on SR2 on 2013-12-06; 90%, an Evolution/The Marketplace seller; <10%, an Agora seller; >75%, the Project Black Flag hacker; 46% & 52%, the Evolution seller fun-gee; 10%, GrandWizardsLair & 1-2% use multisig when available; a large fraction of AlphaBay users in 2016/2017 according to people who saw the leaked PMs) the more attractive an attack on SR becomes to pick up all the buyer addresses being sent in the clear and the more feasible a mass raid becomes.)

Fortunately, I don’t think LE is authorized to engage in cyberwar (#1) or mass entrapment & fraud (#2)—and who knows, maybe SR could survive both. We’ll see.

Fight Club

Whenever classic (and illegal) cypherpunk applications are implemented using Bitcoin, you are sure to find someone complaining that you must not talk about Fight Club—how will that play in Peoria⸮ You will find quite a few, actually, as much as one would expect Bitcoin to select for hard-core libertarian types9 or techies who have internalized the Streisand effect; indeed, the moderators of the Bitcoin forum have—in a crime against history—deleted the early threads about SR, including the thread that saw SR announced. (I posted a short thread linking this page, and I give it about 25% odds of being moderated/deleted; a few hours later, the thread had been deleted. I had drastically underestimated the cowardice of the forum moderators.)

This is a certain double-bind and unfairness in such criticism. Would such critics be congratulating me if this article turned out to help Bitcoin by discussing and documenting a demand driver and important test-case? I suspect they wouldn’t. Their argument is unfalsifiable and based more on their prejudices than hard data.

To such people, my general reply is: what makes you think I want Bitcoin to succeed? It’s interesting but that doesn’t mean I have drank the Kool-Aid. If SR coverage hurt Bitcoin, I may not care.

And I would argue the contrary: I believe SR coverage helps Bitcoin. SR has not been harmed by its national coverage; the number of accounts and transactions have all increased dramatically, and SR’s admin has stated his satisfaction with the new status quo on the SR forums and on Gawker, and said later that “Silk Road was never meant to be private and exclusive.” (2012-01-09, “State of the Road Address”); as has a co-founder of a British Bitcoin exchange.

Not that the SR admin ever sought secrecy—he announced SR’s official opening on the Bitcoin forums! Purchases of Bitcoin noticeably spiked after the Gawker article as already mentioned, and one cannot buy that much publicity. One might say of self-censorship that “C’est pire qu’un crime, c’est une faute.”

And suppose SR coverage did hurt Bitcoin even to the extent that it would be worth devoting one neuron to thinking about it; I would publish anyway because that would mean that the Bitcoin experiment has failed and must be terminated immediately. If Bitcoin is not safe for the drug dealers, then it is not safe for anyone; if Bitcoin can be hurt by the truth, then it is already doomed—you cannot build on quicksand, and “that which can be destroyed by the truth should be.” Good game, chaps, let’s all meet back here when the next Satoshi Nakamoto figures out how to patch the vulnerabilities.

Preparations

But besides all that, how well does it work? No way to know but to go. So, let’s take a ‘brazen’ stroll down the SR.

SR’s 2 technical claims to fame are the exclusive use of Bitcoins for payment, and access only through the anonymizing Tor network, on which SR and the SR forum live as “hidden sites”—both you and the server funnel your requests into a set of Tor nodes and you meet in the middle. (This isn’t as slow as it might sound, and hidden sites eliminate the main security weakness of Tor: evil exit nodes.) Tor itself is secure, but this doesn’t mean as much as one might think it means: while Tor itself is basically the securest software you will ever use (or at least, it is far from the weakest link in your chain), what always kills you is what you choose to communicate over Tor: what you browser sends or doesn’t send, or the personal details you put on your seller page or brag about on Tumblr/Instagram with pictures/Venmo (making for easy arrests), or the mailing address you foolishly choose to send over it plaintext & unencrypted (vulnerable until the item ships) or the revealing message (vulnerable >2 months)10, or the pseudonym you choose to confide in, etc. Tor is a tool which does one thing very well: keeps secret the communication between your computer and someone else’s computer. It does nothing whatsoever about anything that other computer may be able to figure out or record about you or what you choose to send. The perfectly secure envelope does little good if the person you’re mailing your confession to is a policeman.

But as any kidnapper knows, you can communicate your demands easily enough, but how do you drop off the victim and grab the suitcase of cash without being nabbed? This has been a severe security problem forever. And bitcoins go a long way towards resolving it. So the additional security from use of Bitcoin is nontrivial. As it happened, I already had some bitcoins. (Typically, one buys bitcoins on an exchange like Mt.Gox, although the routes are always changing, so see the Bitcoin wiki’s buying guide; the era of easy profitable ‘mining’ passed long ago.) Tor was a little more tricky, but on my Debian system, it required simply following the official install guide: apt-get install the Tor and Polipo programs, stick in the proper config file, and then install the Torbutton. Alternately, one could use the Tor browser bundle which packages up the Tor daemon, proxy, and a web browser all configured to work together; I’ve never used it but I have heard it is convenient. Other options include entire OSes like Tails or Liberté Linux, which can be used on bootable Flash drives. (I also usually set my Tor installation to be a Tor server/middleman as well—this gives me more anonymity, speeds up my connections since the first hop/connection is unnecessary, and helps the Tor network & community by donating bandwidth.)

Silk Road

With Tor running and the Torbutton enabled in the browser (along with any privacy mode), we can easily connect to SR; we simply visit silkroadvb5piz3r.onion11. (Newbies to Tor might wonder why the gibberish address. The address is derived from the public key of the server, making it more difficult for an attacker to pretend to be the real SR or do a man in the middle attack.)

Upon connecting, you will see a bare log-in form:

2011 SR log-in form on the homepage

Alternately, you might see an error page like the following; SR is occasionally down for maintenance & new features or temporarily overloaded. Usually waiting a minute is enough, and longer downtimes are discussed on the SR forums.

2011 server error example

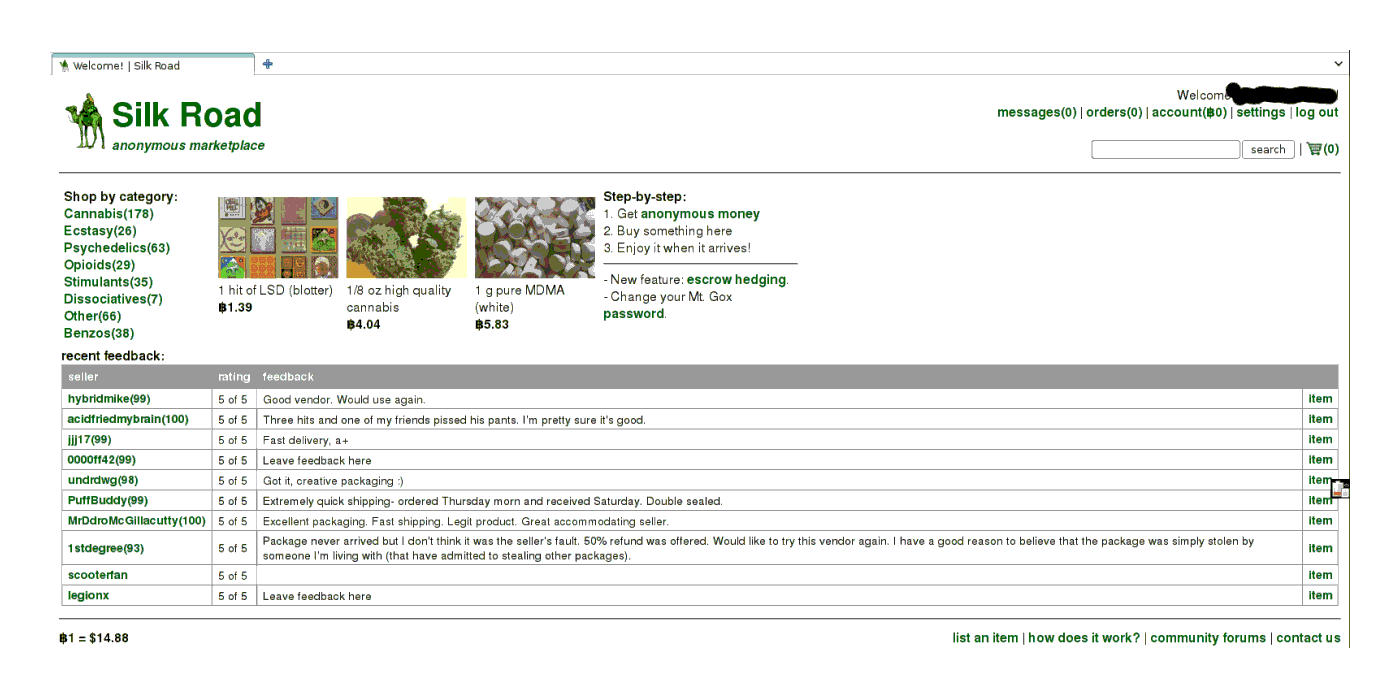

Click on the join, and you will be taken to another page for registering your account, much like any other site. Invitations are not currently required, although to register a seller account is neither easy nor cheap, see later sections. (I suggest picking a strong password12. Learn from the Mt.Gox fiasco.) With your new account, you can now log in and see what there is to see on the main page:

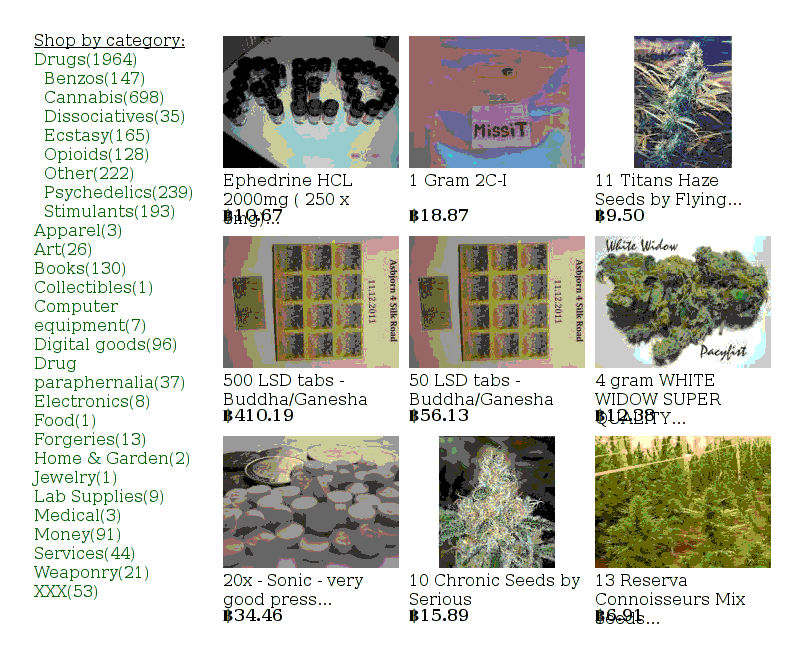

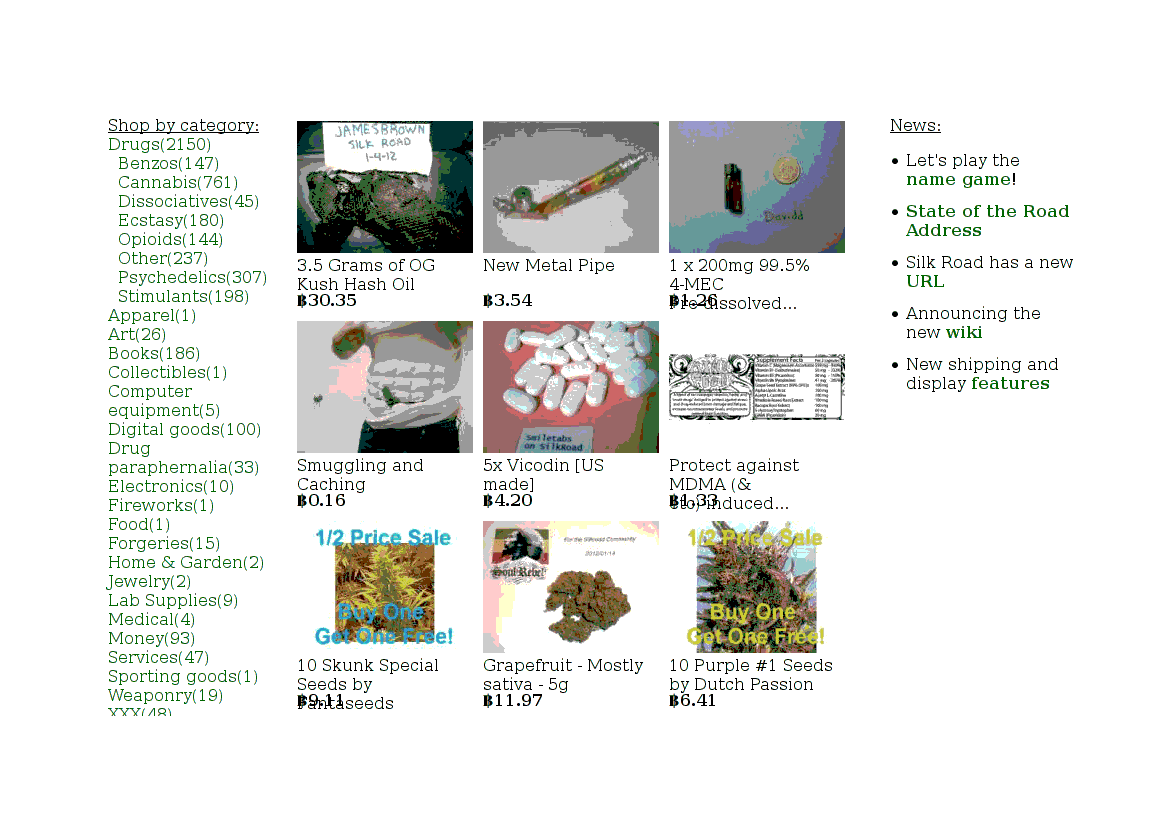

The front page, displaying random images of merchandise on offer, categories of listings, and recent feedback posted by buyers

At another time

And another time

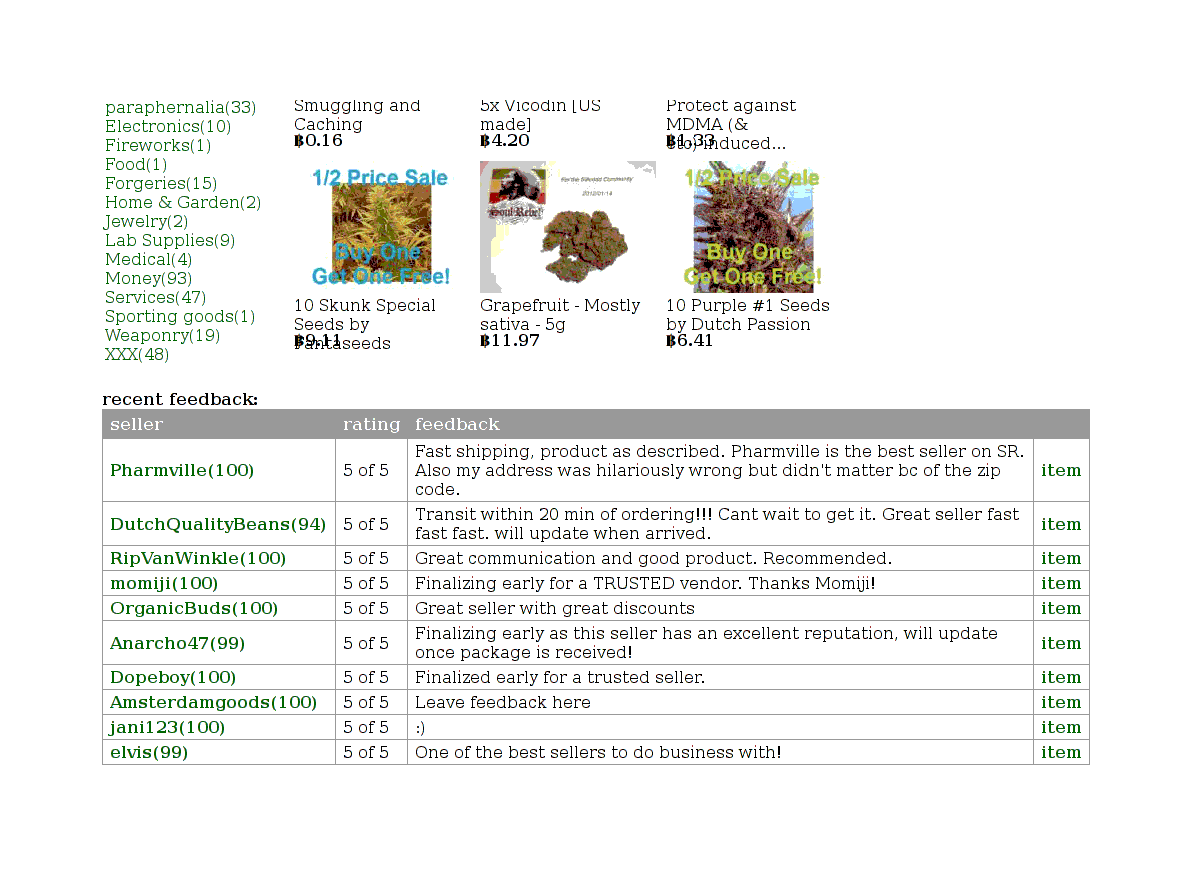

Notice at the bottom, below the random selections, is a section listing all the most recent reviews from buyers; feedback from buyers, like on Amazon or eBay, is crucial to keeping the system honest:

Seller feedback

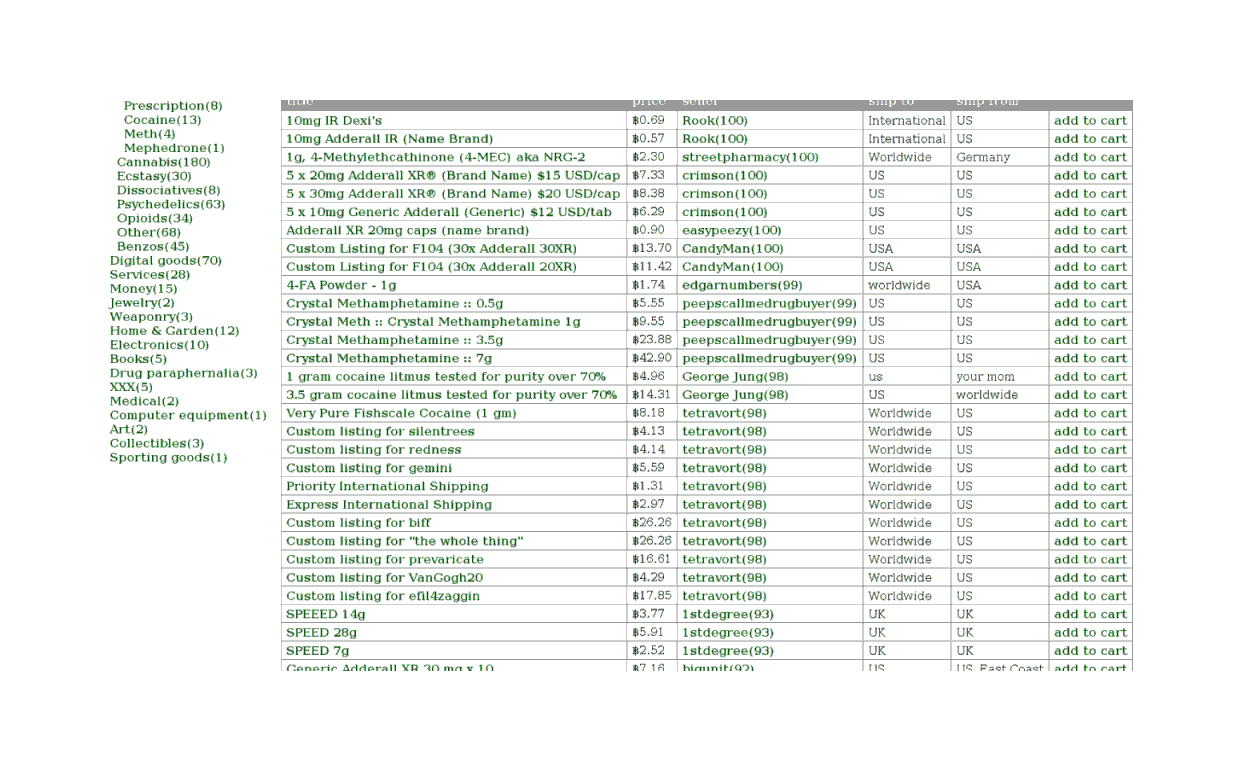

The stimulants category contains much what you’d expect:

2011 listing of stimulants: Adderall, 4-FA, methamphetamine, cocaine

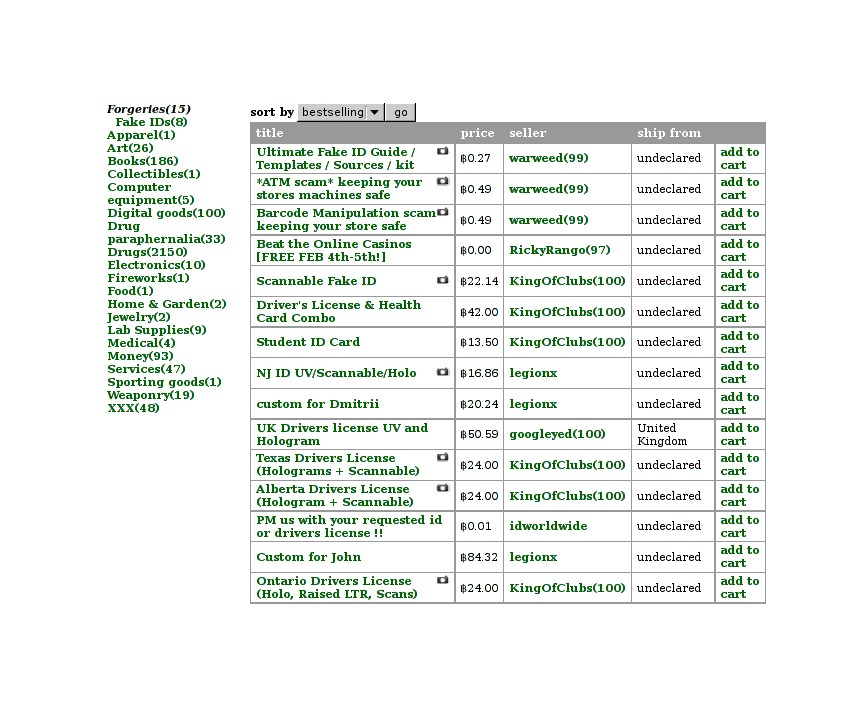

Moving on, we have the section for selling forgeries:

Forgery selection

Legal Wares

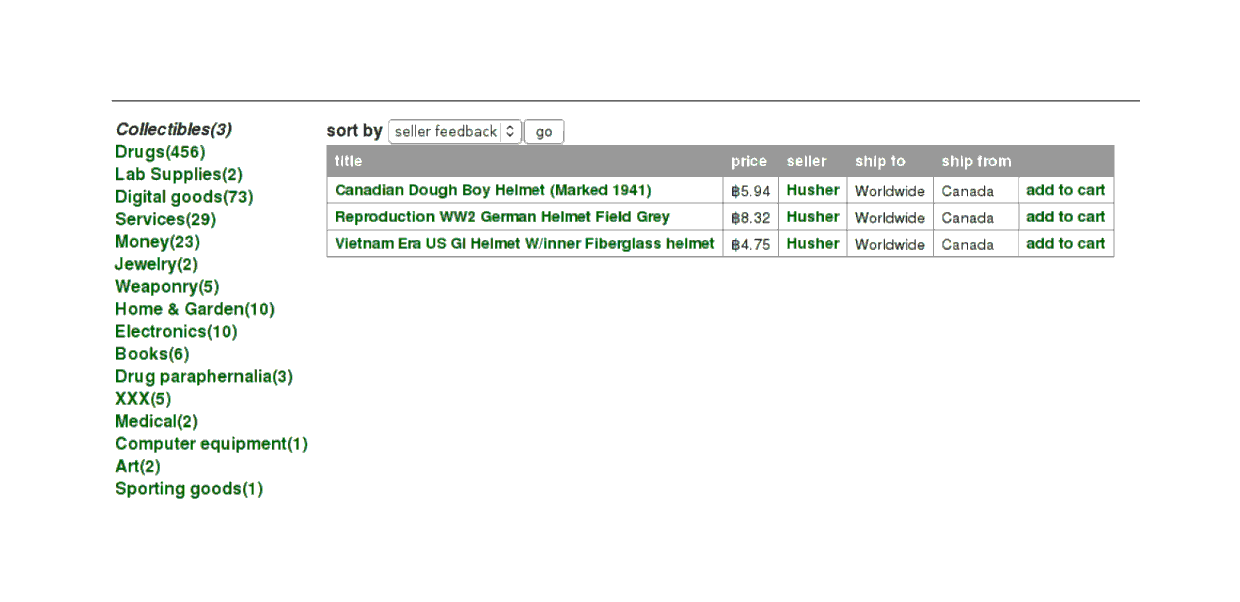

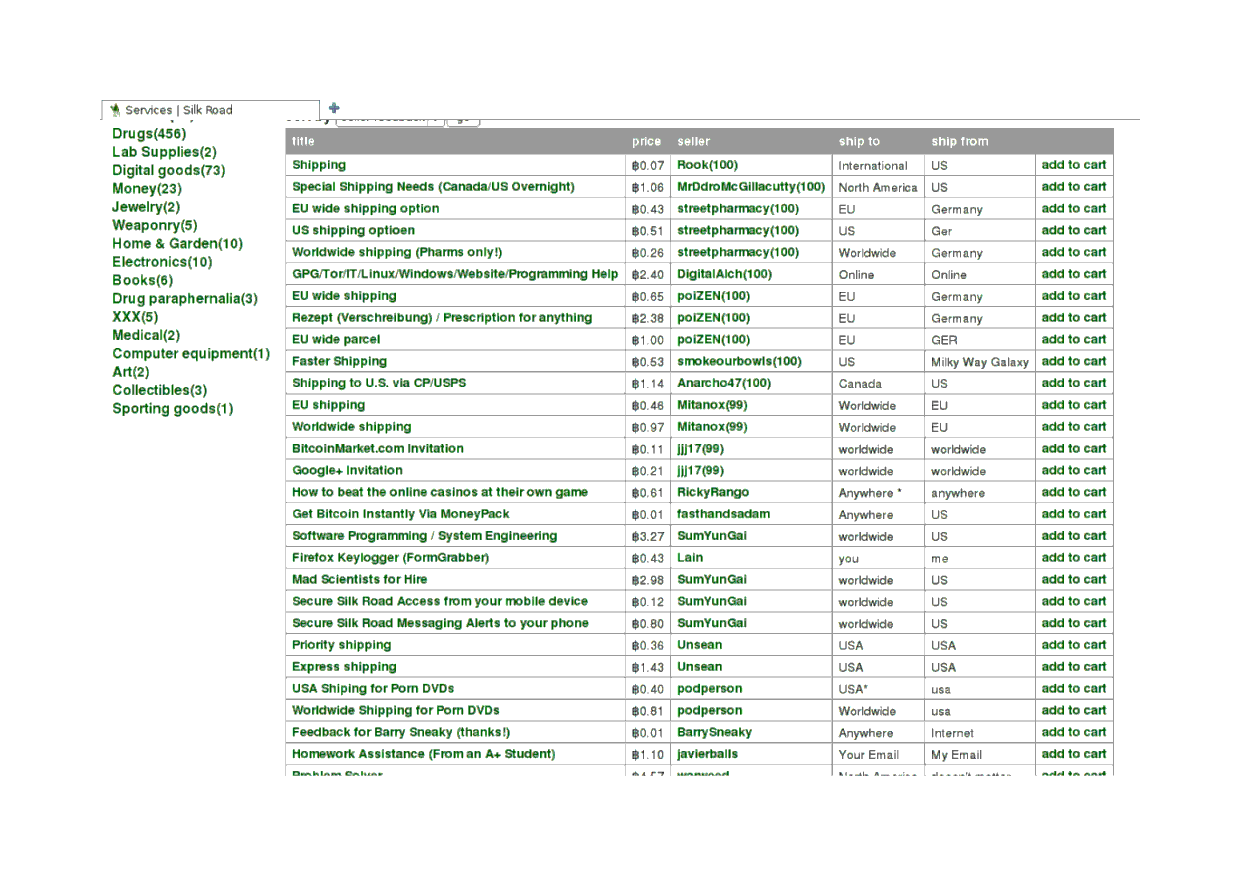

Perhaps more surprising are the non-drug listings. They don’t get mentioned much in the usual coverage, but SR has aspirations of being a marketplace for more than just drugs. For example, the collectibles category with its military surplus or replica helmets, or German pretzels, or the ‘services’ category, which has, interestingly, become a way for sellers to offer ‘extras’ with their wares like faster shipping (or just oddball offers, like one offering to write a German prescription for any prescribable drug in Germany):

Collectibles category: 194185ya Canadian military helmet, reproduction German military helmet, Vietnam War American military helmet

Services category: upgraded shipping, manuals, website invitations, homework grading

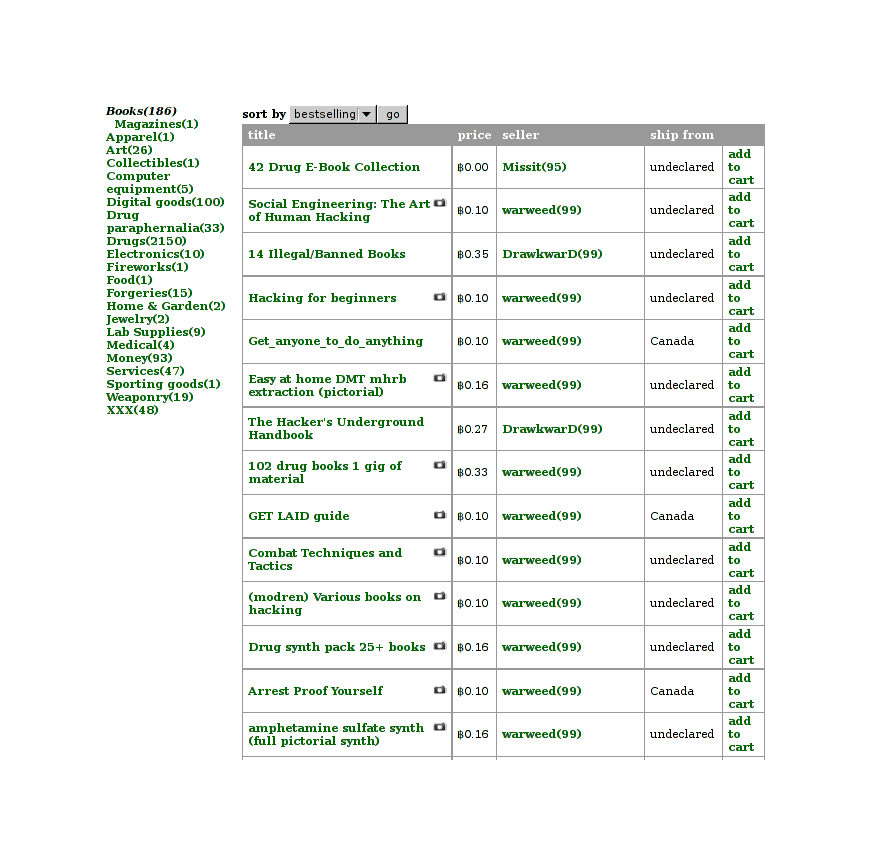

There’s also the book section, with its predictably less than commendable but perhaps not actually illegal wares:

Guides to committing illegal activities

Although reportedly the book section can also be used to buy books censored for political reasons in China (“Bitcoin bursts: Hacker currency gets wild ride”, AP Digital):

One British user told AP he first got interested in SR while he was working in China, where he used the site to order banned books. After moving to Japan, he turned to the site for an occasional high.

This is a handy reminder that even if you happen to agree with some drug laws, there are many other laws domestic & foreign one might disagree with (bans of Kinder eggs, extremely costly regulation of venison, sex toys etc.).

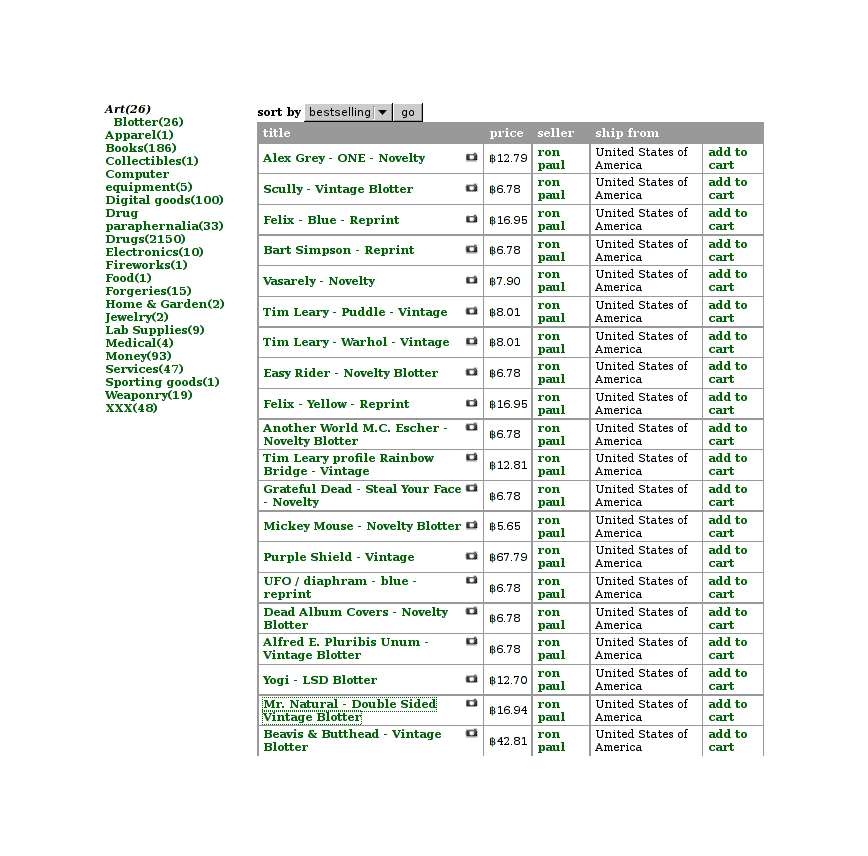

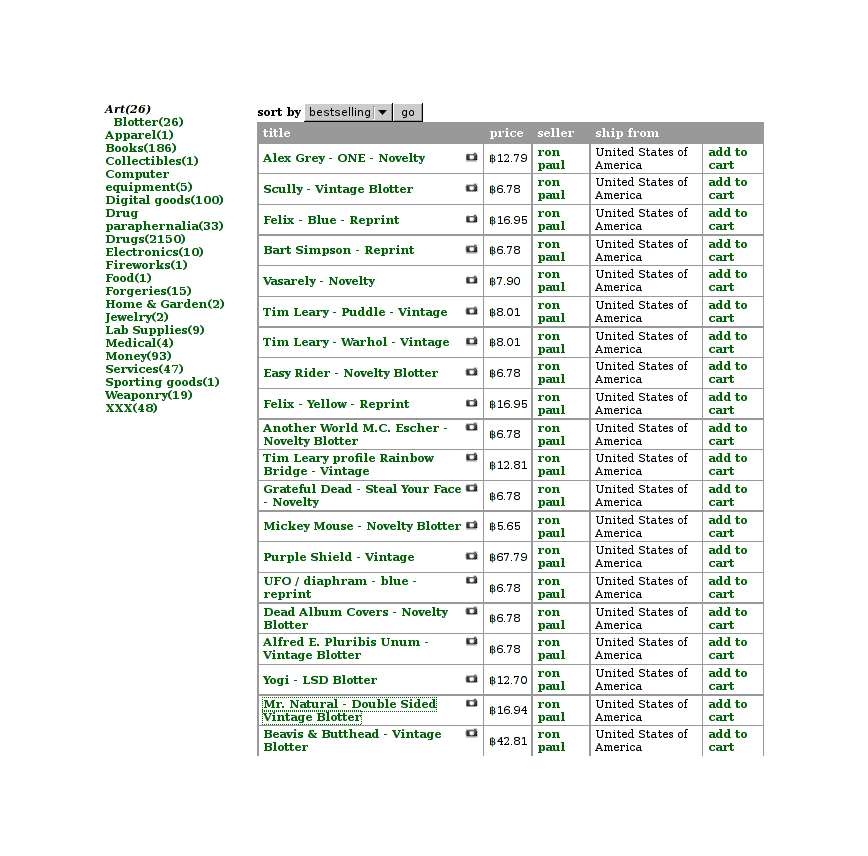

One section that perplexed me when I browsed it was the art section, for blotters:

Blotter selection

An euphemism for the LSD section? Apparently no—they seem to be genuine little bits of Americana, without any LSD in them, when I looked at one item more closely. (The art doesn’t appeal to me, and it seems like a risky kind of art to collect, but it takes all sorts.)

A vintage LSD blotter with artwork on it

Besides the mentioned blotter artwork, books, Kinder eggs, and venison, I was curious how many legal goods were available on SR in general. (Also amusing: fig tree cuttings were sold on Atlantis.) On 2013-04-17, I visited SR, archived the first page of each category, and then did some guessing at the legal fraction of the 25 items on the first page for each category. (If there was only 1 page / <25 items, I simply eyeballed what was there.) Evaluating the legality of drugs is difficult because many are regulated differently in jurisdiction (an Englishman can legally import modafinil while an American is breaking the law), are unregulated (analogues), or may be regulated differently based on the exact chemical form (the former American legal distinction between forms of cocaine); hence, I ignored the drug & drug paraphernalia sections. Copyright infringement is counted as illegal (so an e-book counts, but a physical book doesn’t), but hacking tools are not since I am unclear on what hacking tools, if any, are either criminal or civilly prohibited. My results:

Category |

Total items |

Questionable |

Notes on items |

|---|---|---|---|

Drugs |

8845 |

100%? |

|

Drug paraphernalia |

337 |

100%? |

|

Apparel |

321 |

100% |

Counterfeit or knockoff goods |

Art |

112 |

8% |

Blotter art, pornography (copyright infringement) |

Biotic materials |

2 |

0% |

Opium tea (apparently legal), damiana (banned in Louisiana only) |

Books |

878 |

12% |

Copyright infringement (e-books) |

Collectibles |

13 |

8% |

Moonshine |

Computer equipment |

67 |

0% |

Specialized but legal software, hardware |

Custom Orders |

82 |

32% |

Most do not specify what they are for; 8 are drug-related |

Digital goods |

655 |

16% |

Site accounts or invites |

Electronics |

92 |

4% |

Counterfeit/knockoff |

Erotica |

612 |

100% |

Copyright infringement, site accounts |

Fireworks |

4 |

0% |

|

Food |

10 |

4% |

Moonshine |

Forgeries |

100 |

92% |

Driver’s licenses principally |

Hardware |

33 |

0% |

Hard drives, safes, night vision goggles, lockpicks |

Herbs & Supplements |

6 |

0% |

Not that I recommend maca root as an aphrodisiac… |

Home & Garden |

9 |

0% |

Poppy plant seeds, Gillette razors, Mylar film, electric lights |

Jewelry |

93 |

96% |

Counterfeit/knockoff (mainly Cartier/Hermes/Montblanc/Gucci) |

Lab Supplies |

46 |

0% |

Glass vials, flasks, mushroom spores, tablet machine |

Lotteries & games |

82 |

100% |

Presumably all such gambling is regulated |

Medical |

36 |

36% |

Needles/syringes, tablet machine, prescription drugs |

Money |

145 |

0% |

Cash, debit cards, bullion, guides |

Musical instruments |

2 |

100% |

Beta blockers (when asked, seller said “They were put there over a year ago for musicians to find as they are a very practical musical tool.”) |

Packaging |

49 |

0% |

Plastic bags, stamps, heat-sealing equipment |

Services |

81 |

24% |

DDoS; username/password cracking; many takers for ‘Common Sense’? |

Tickets |

1 |

0% |

? |

Weight loss |

53 |

84% |

Drugs; 2,4-Dinitrophenol, clenbuterol etc |

Writing |

4 |

0% |

Drug sampling/review; ghost paper-writing; custom poems/stories |

Yubikeys |

4 |

25% |

An Adderall listing (another miscategorization?); intended for two-factor authentication products |

Extrapolating to all the other public listings and multiplying out the percentages, my table suggests 10709 questionable/illegal products out of 12774 total public listings, or ~83% of SR public listings are illegal goods. (It assumes all drug/drug paraphernalia are illegal, that the first page listing is representative, does not try to assess private listings which will likely skew to illegal drugs, etc.) This is much lower than I expected, but this estimate tells us little about how much is actually bought & sold, how much turnover there is, and what fraction of each are illegal.

Anonymity

Well, you’ve browsed through the SR proper. You can also visit the official SR forums at dkn255hz262ypmii.onion. The discussions are indispensable tools for learning about sellers and getting the latest rumors like indicators of FE scams, but the forums are also where official rule changes to SR are announced by the SR administrator.

We have window-shopped long enough. It’s time to take the plunge and buy something. Bitcoin developer Jeff Garzik is quoted in the Gawker article as saying that “Attempting major illicit transactions with bitcoin, given existing statistical analysis techniques deployed in the field by law enforcement, is pretty damned dumb.” Fortunately I do not plan ‘major’ transactions, and in any case, I tend to suspect that said statistical techniques are overblown; a few academics have published initial investigations into tracing transactions and examining the larger Bitcoin economy, and have linked transactions to individuals, but as of 201214ya have only done so with addresses publicly linked to identities, and not broken the anonymity of people trying to be anonymous.

The public nature of transactions means that many interesting connections & graphs can be generated and analyzed. But fortunately, it’s straightforward to anonymize Bitcoin transactions (mixing services13) by a method analogous to the Tor network we are relying upon already: route the money through several intermediaries in several quantities and reconstructing the path backwards becomes nontrivial.

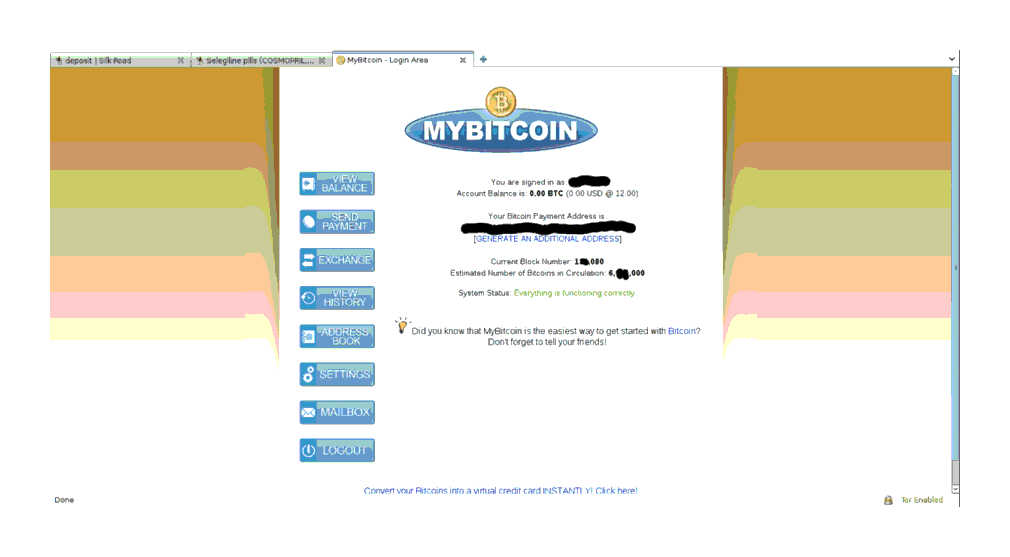

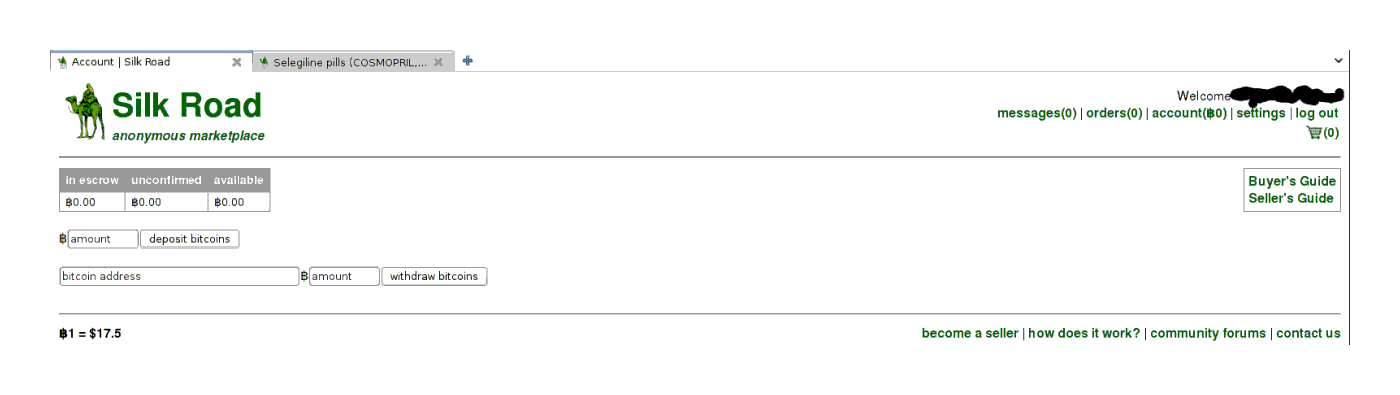

My own method was to route 4 bitcoins through Mt.Gox (this was before the hacking, a series of events which confirmed my own resolution to keep a balance at Mt.Gox for as short a time as possible; a retrospective analysis of Bitcoin exchanges suggests that for every month you keep a balance at an exchange, you run a ~1% chance of losing your money), then through MyBitcoin (which at the time was still considered trustworthy)14. This was straightforward—sign up for a throwaway account:

MyBitcoin (defunct) login page

Then deposit to the one-use address:

MyBitcoin deposit interface

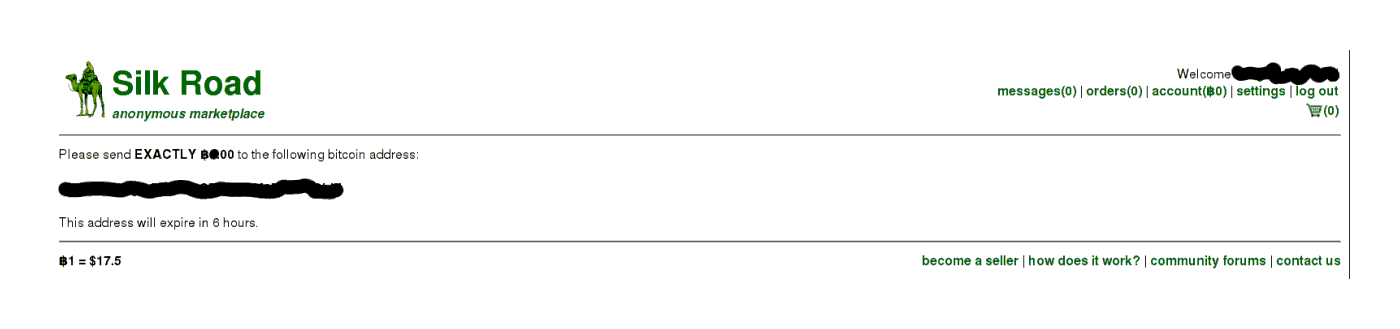

A day or three later, I am tired enough of the game to route my Bitcoins into the last set of anonymizing mixes, SR’s own cointumbler. How do we do a deposit? We click on the link in the profile and see:

SR bitcoin deposit form interface

No big surprise there—it’s another one-time address which expired at noon, so there’s no time to shilly-shally:

SR deposit instructions: send bitcoins to this address etc.

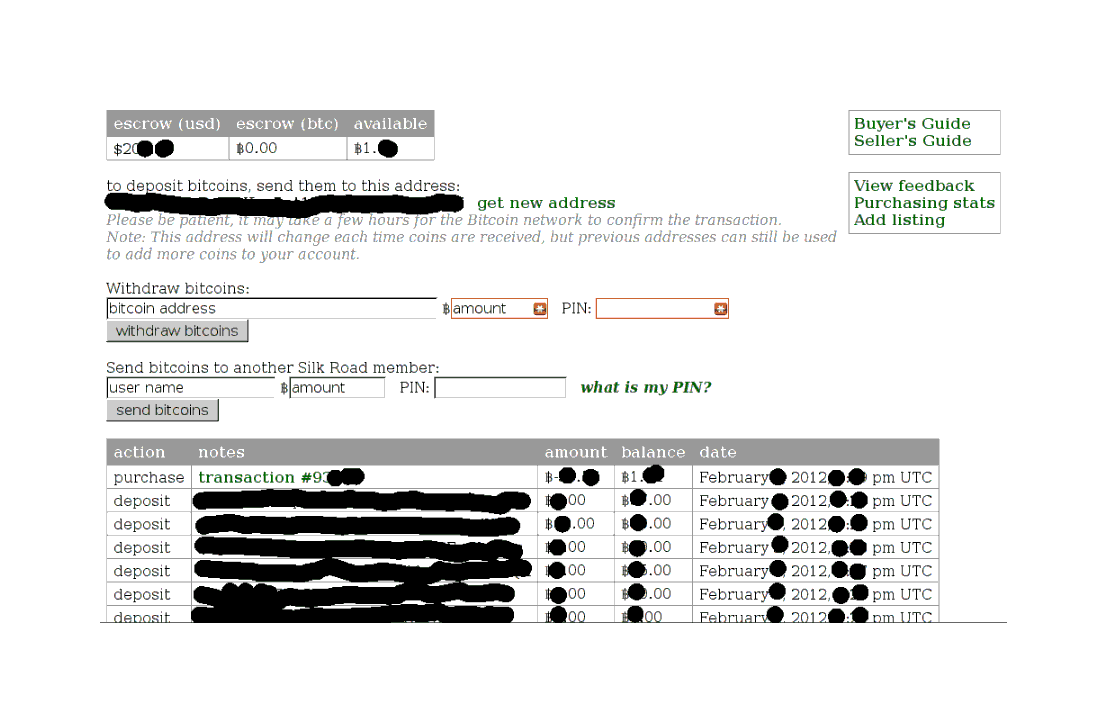

Once deposits have been made or purchases entered into, one’s profile page begins to look like this:

A record of deposits and withdrawals

Shopping

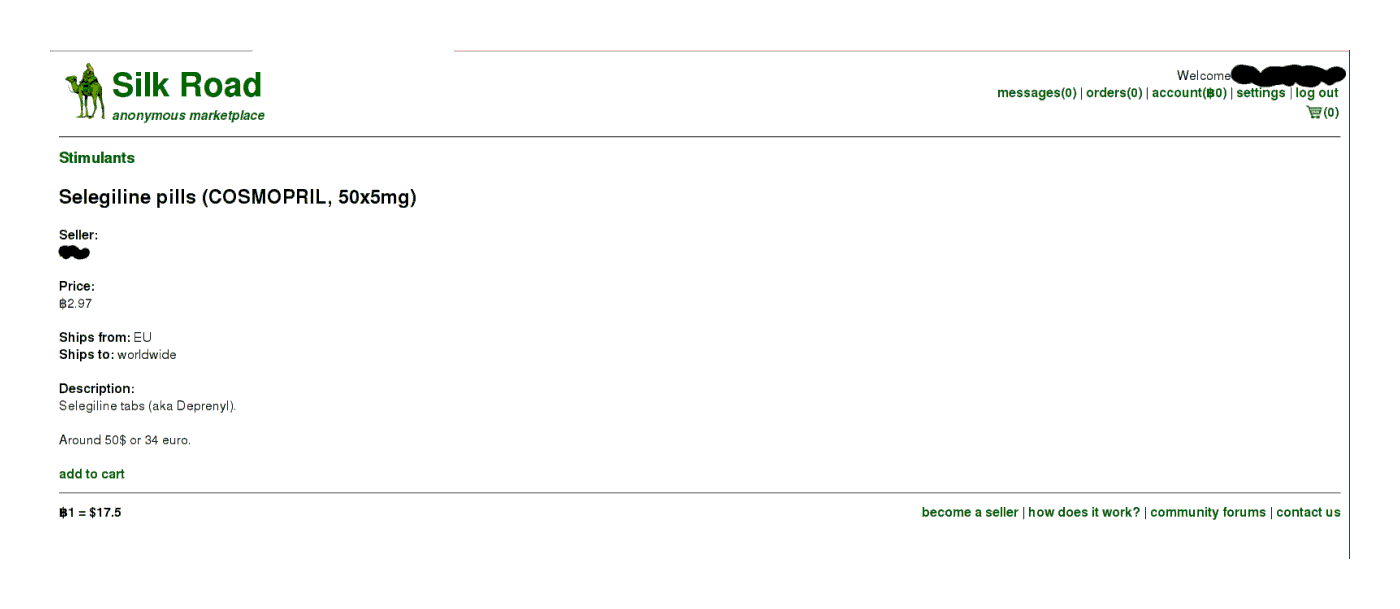

After some browsing, I personally decided on an offering of the nootropic selegiline. Safe, potentially useful, and not even especially illegal. The price was right:

Bare-bones selegiline listing

Should I buy it?

Evaluating Sellers

Now, you will notice that for most sellers, there is no ‘(99)’ or ‘(100)’ after the seller’s name; for example, this random seller has no such indicator:

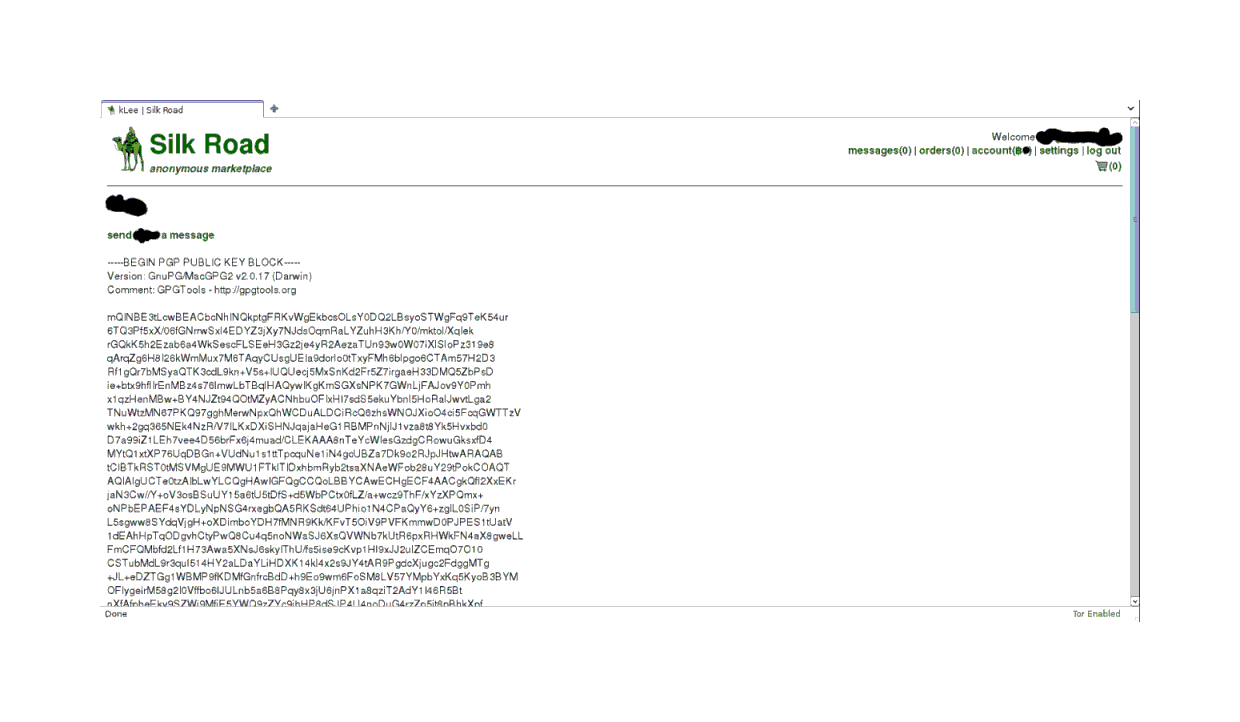

seller profile page with public key

This is due to the simple fact that when I joined, the post-Gawker rush had resulted in membership jumping from the high-hundreds/low-thousands range to north of 10,000 accounts, and while many transactions had been entered into, the reviews and closures of transactions had only started. So I was not too bothered by the lack of feedback on this seller profile. I also used the handy SR forums and found no bad mentions of the seller. The user number was not terribly high, the description was detailed enough that it looked like he took selling seriously, there are no bad reviews, they posted a public key, etc. So, I was willing to take a chance on him.

Both the seller and the example above had standard PGP-compliant public keys posted (the long string of gibberish under that odd header—quite unmistakable), which one will need to encrypt the personal information one sends the seller15. (It is a given on SR that sellers have public keys; any sellers who does not provide public keys should be shunned no matter how good they seem, and you instantly fail at security if you send the seller the address unencrypted. You are also making SR a bigger target by doing stuff in the clear, because the site is holding more valuable information.) Public-key cryptography is an old and vital concept to understand, and there are a great many descriptions or introductions online so I will not explain it further here.

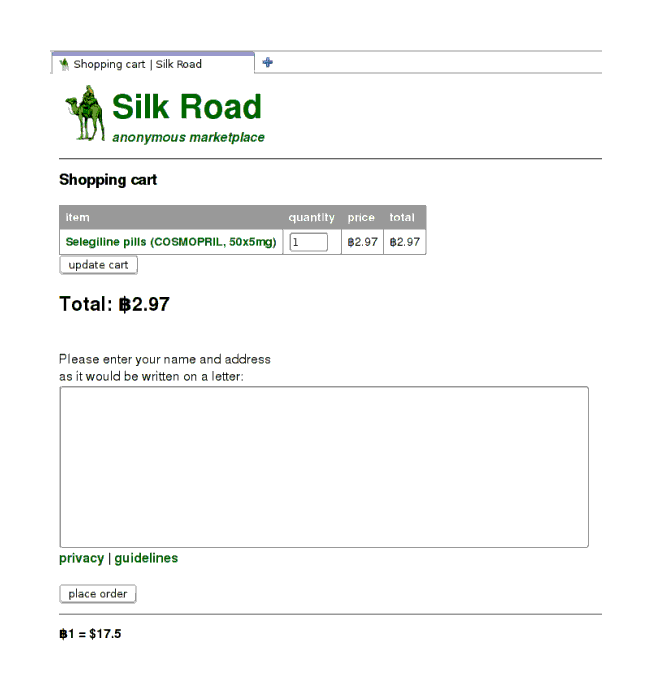

I add it to my cart:

Selegiline: shopping cart form—fill in form and push the button, if you dare

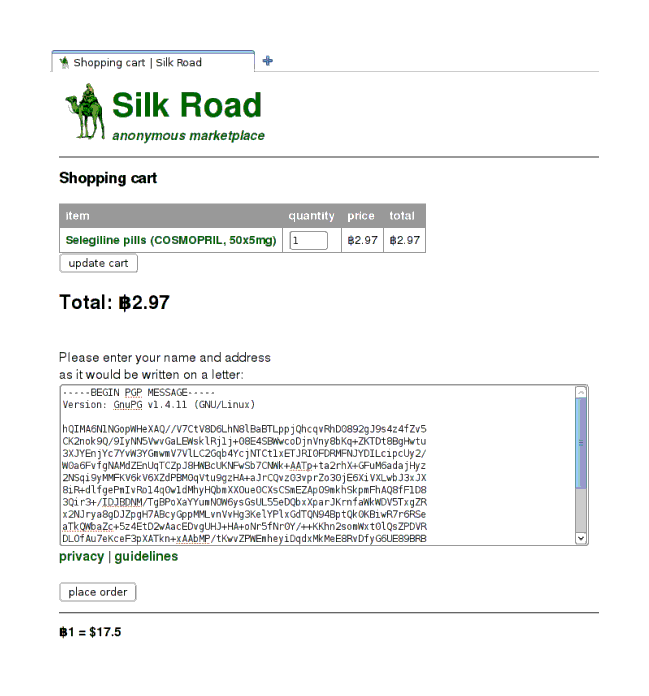

Notice the address field. Now, I could be a chump and put down my friend’s address in the clear. But what if SR itself is compromised? Right now, SR doesn’t have anything about me, but the address is a good starting place for finding me. So, I go to the seller’s profile, and like the example above, my seller has posted his public key. I want to encrypt the address against that public key. How?

Encryption

There are a great many guides to GPG; the official GPG handbook, the Ubuntu guide, Heinlein’s “Quick Start”, the PGP Encryption Video Tutorial, & /r/SilkRoad wiki work well enough. To summarize what I did:

I copy the public key into a text file named

key.txtI tell GPG to memorize it:

gpg --import key.txtGPG will spit out some output about how it now knows the public key of

nobody@cypherpunks.cometc.I write down her address in a file,

address.txt,and I encrypt it:

gpg --recipient nobody@cypherpunks.com --encrypt address.txt --output address.gpg --armorHopefully the options make sense. (We need

--armorto get an ASCII text encrypted file which we can copy-and-paste into the shopping cart’s address form, rather than a smaller file of binary gibberish.) An example of doing this right:

Selegiline shopping cart: with the encrypted address to send the selegiline to

Now, one might wonder how one would post one’s own public key in case one asks questions and would like the answers from the seller to be as encrypted as one’s addresses. It’s easy to make one with gpg --gen-key and then a gpg --armor --export USERNAME, but where to post it? It used to be that you could simply push a button in your profile to register as a seller and then fill your own profile field with the public key like any seller, and I did just that. But SR closed free seller accounts and required large up-front deposits, and has announced that they are being auctioned off. The justification for this is SR claims to have received an anonymous threat to register many free seller accounts and simply mail poisoned pills out (which he alluded to earlier). Hopefully buyers will soon be able to edit their profile, but until then, there is a thread on the SR forums devoted to buyers posting their public keys.

Now What?

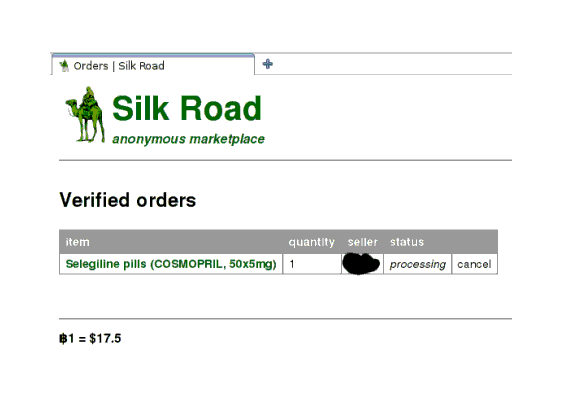

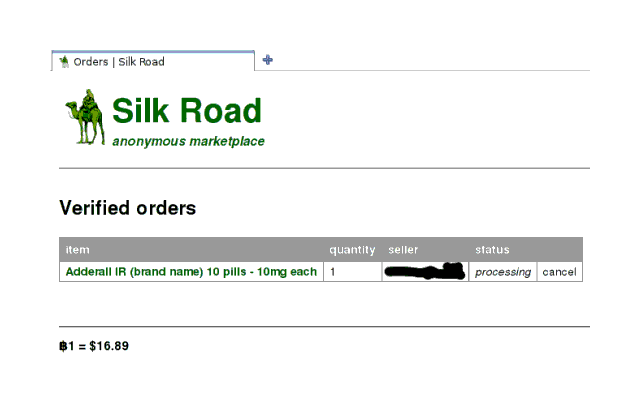

Once you have submitted the order, the ball is in the seller’s court. The order is listed in your shopping cart as ‘processing’:

And done

Your balance also instantly decreases by the price, and if you look at your balance/transactions page, you will notice that that amount is listed as in escrow16. SR holds onto your Bitcoins until you finalize17 the transaction with a review—one of the protections for the buyers.

It’s worth noting that the buyers bear the real risk on SR. A seller can easily anonymize themselves and send packages without difficulty: simply drive out of town to an obscure post office and mail it, leaving behind fuzzy surveillance recordings, if even that18. Even using the “mail covers”—photographs taken by the USPS of the exterior of all packages mailed in the USA, data heavily exploited—database would not help because presumably no genuine information about the sender is recorded on packages, although the USPS hidden camera surveillance would. (The SR forums had a subforum on shipping, as do the replacement forums.) A buyer, on the other hand, must at some point be physically present to consume the ordered drugs or items. There’s no way to cleanly separate herself from the shipment like the seller can. Shipping is so safe for the seller that many of them will, without complaint, ship worldwide or across national borders because customs so rarely stops drug shipments. For example, only 1 of my shipments of any supplement or substance I have ordered has been held for a signature; the other few dozen have never been stopped or apparently looked at hard by a Customs official. In the 2 SR orders’ cases, this turned out to be irrelevant as both sellers were in-country. 2013 remarks with surprise on how freely sellers sell internationally, but rightly looks to the minimal risks sellers bear and incentive they have for broad markets to explain this casual disregard. One of the corollaries of this shift of risks from the seller to the recipient is that a viable method of attacking someone is to get their address and order, say, heroin for them off SR as happened to security journalist Brian Krebs in July 201313ya (Krebs enjoys another dubious distinction: being a victim of Swatting). Sheep Marketplace decided to shut down its gun offerings 2013-11-08 due to “actions undertaken by a particular gun vendor where he threatened to kill a users family and began exposing addresses” (possibly “gunsandammo”).

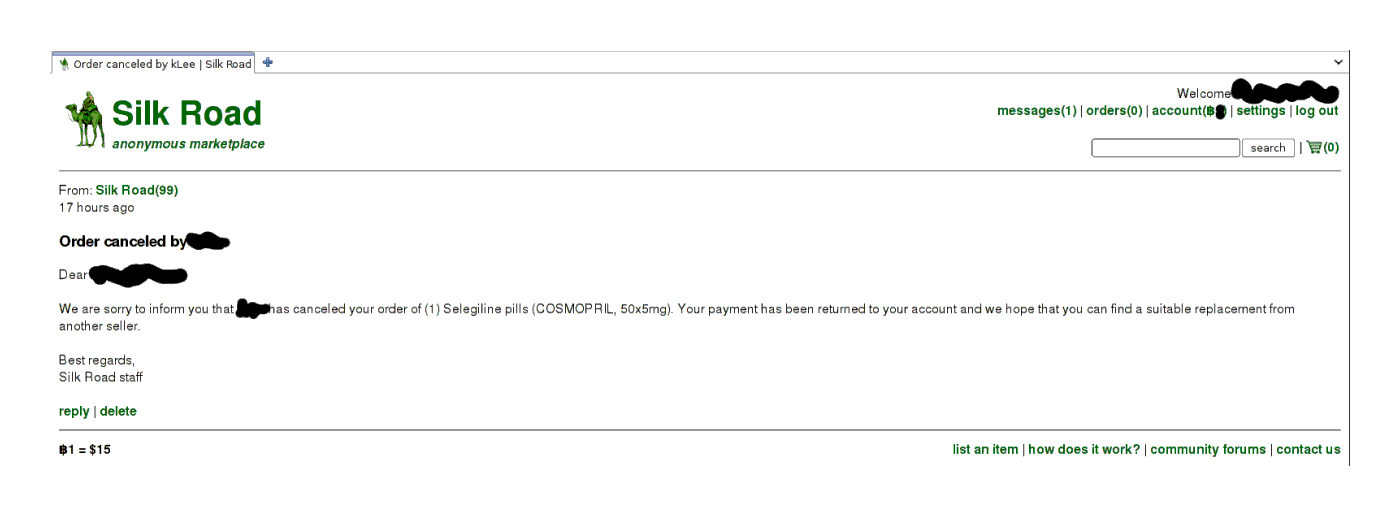

I check in 1 day later: the order still processing. Items apparently aren’t public once you’ve escrowed your dosh. 2 days later: still processing. 3 days later: canceled! My Bitcoins are unlocked, of course, but I’m not keen on ordering again right away. Need to browse more and look for deals. The cancellation message is not very informative:

Order canceled, funds refunded

Well sure, but why was it canceled? I speculate the seller decided he didn’t want to send outside the EU despite his listing claiming he would—perhaps shipping cost more than he had factored into his price. (I checked back a few weeks later, and the seller says he canceled all orders and got a new public key because the Mt.Gox exploits have made him paranoid. I can’t really fault him with that rationale. I wish he had mentioned it before, I would have cut him some slack.)

Try, Try Again

After some more browsing, I decide to go with either the cheapest Adderall or the new modafinil posting, which mentioned being Provigil. (Here it was that I decided my ordering risk is very small, for a variety of reasons19, and to go forward with my investigation.) But is it real branded Provigil or just the usual Indian generics? Also, the Adderall seller has no public key listed! I take this opportunity to message the two, asking for more information and to post a public key, respectively.

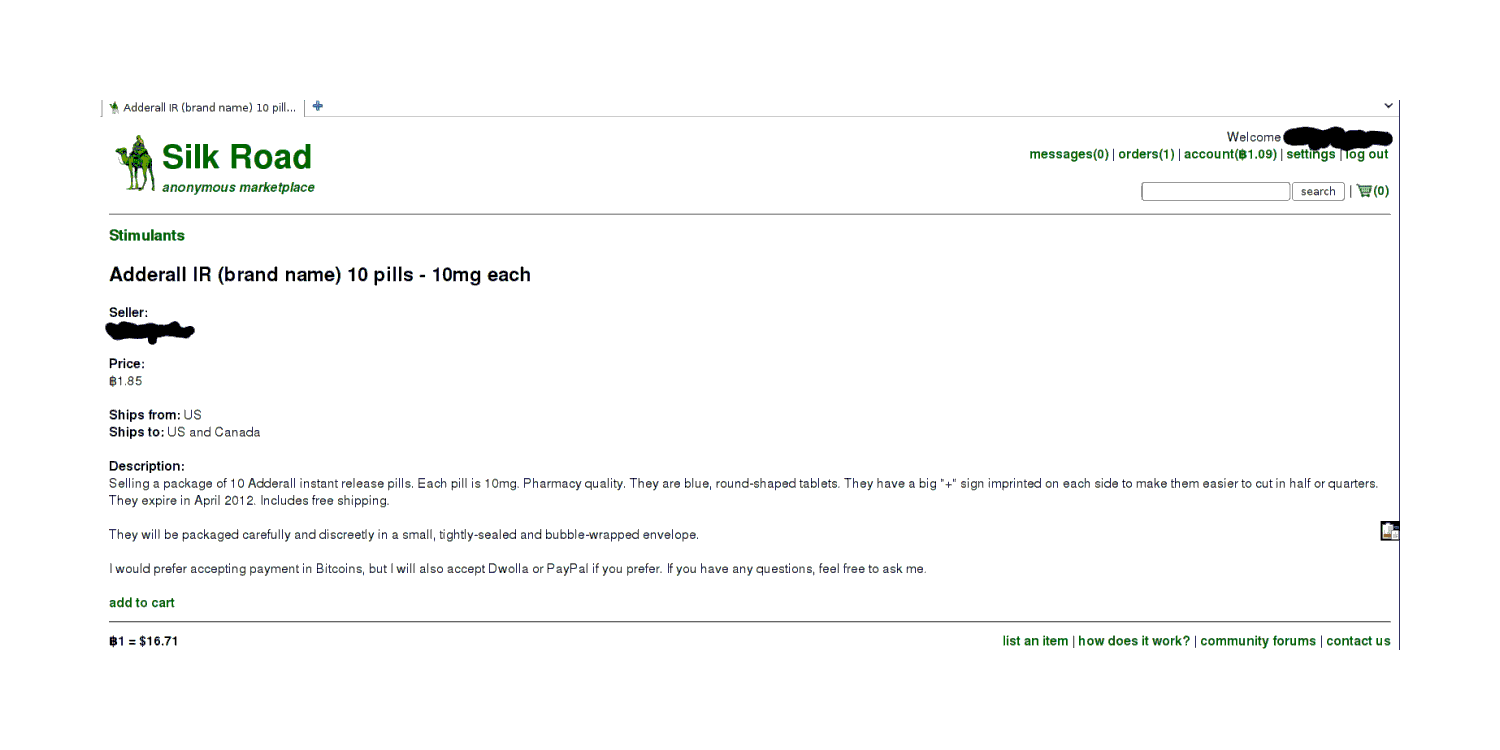

Both have replied the next day; the Adderall seller has put up his public key, and the modafinil seller clarifies it’s Indian—but it doesn’t matter since the item’s page has disappeared, indicating someone bought it already. Naturally, I reply and then delete all messages. One must assume that SR will be compromised at some point… But the Adderall it is. The listing looks pretty good, and the price per pill is superior to that I was quoted by one of my college-age friends (less than 1⁄3 the price, although to be fair it was nearing exams time) and also better than the Adderall price quote in the New Yorker, $15 for 20mg:

Adderall item listing

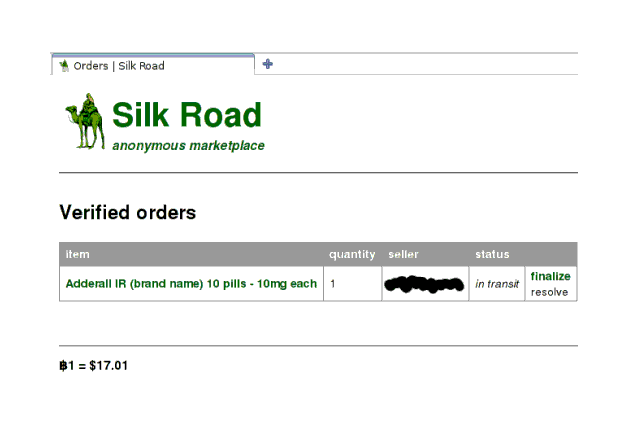

1 day after ordering: still processing, and 2 days, ‘in transit’:

Checking in on the Adderall order: seller is still preparing to send

And now the seller says he’s mailed it

Evaluating and Reviewing

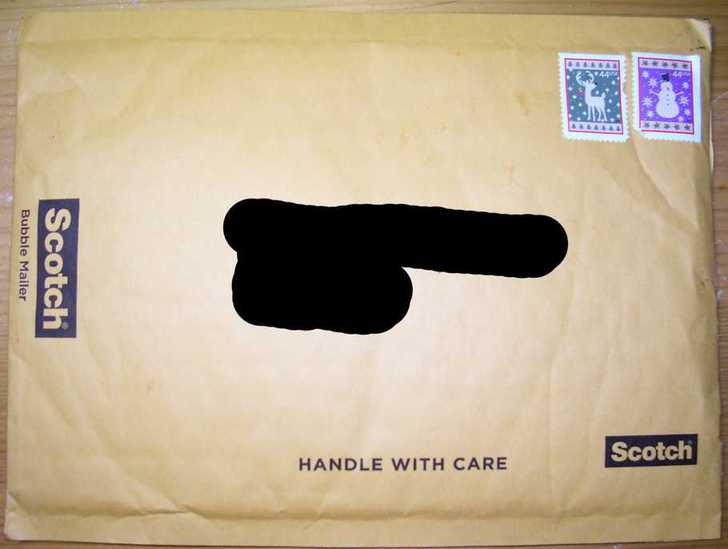

3rd day: still in transit. 4th day: the package arrived! I go over immediately, and it’s this harmless-looking little padded mailer. One would not suspect it of anything nefarious, not with those cute stamps20:

Package of Adderall as received, before opening

The contents are as described, 10 blue Adderall, in a double ziplock baggy (the vacuum-sealed bags are not needed for a drug this low on the importance scale—there are no drug dogs for Adderall):

The Adderall pills themselves in plastic bags

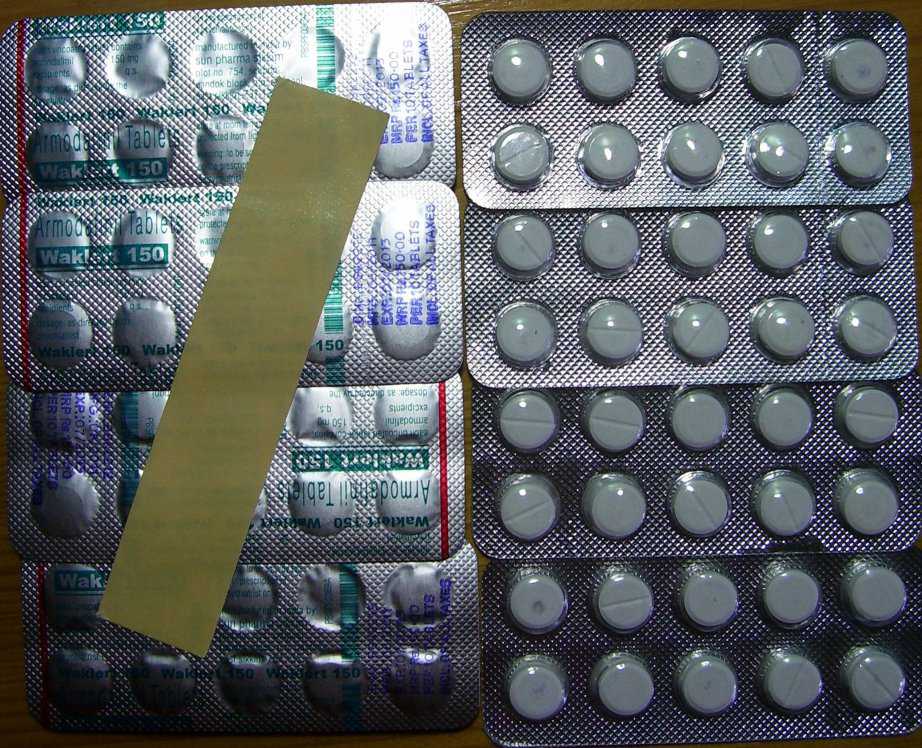

While I have never used Adderall before, the effects are noticeable enough that I am convinced after the first dose that they are genuine (I have continued to experiment with them to somewhat lesser effect). The very sharp-eyed will notice that these are the ‘generic’ Adderall pills, but as it turns out, the generic Adderall pills are manufactured by the exact same pharmacorp as the branded Adderall—the two products are probably a case of price discrimination. Economics can be a counter-intuitive thing. I also ordered generic armodafinil with similar steps since the armodafinil was noticeably cheaper than the regular Indian generic modafinil:

4 of the pills are left after I tested the first one overnight.

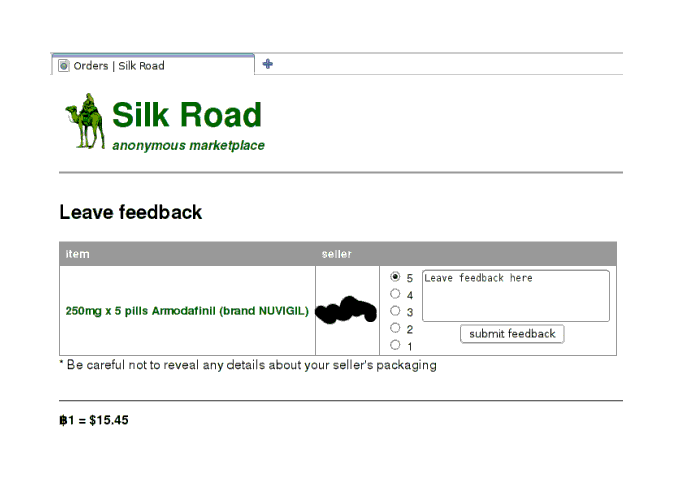

They work fine (I have begun experimenting with them), and I leave the seller a nice review. My third order proceeds as straightforwardly as the second order, and results in an even better packaged shipment of product that seems to be genuine as far as I can tell. Heedful of the risks and probabilities, I leave another nice review; the review form (reached when you click the ‘finalize’ link) is as straightforward as the rest of the process:

The feedback form, after a successful order

Feedback is an important part of the process. I was surprised to revisit one of my seller’s page when 3 or 4 of his transactions has caused him to go from no reviews to 4 positive reviews, and see that his prices had increased a good 30 or 40%. Apparently he had been selling at a considerable discount to drum up reviews. This suggests to me, at least, that existing SR users are a bit too chary of new sellers.

Another transaction; 10x100mg Modalert ordered from an English seller, arrived in larger than one would expect packaging (which contained a pretty nifty way to hide a shipment, but I will omit those details):

The Modalert package as received

The Modalert was what one would expect:

Foil packaging, front

Foil packaging, back

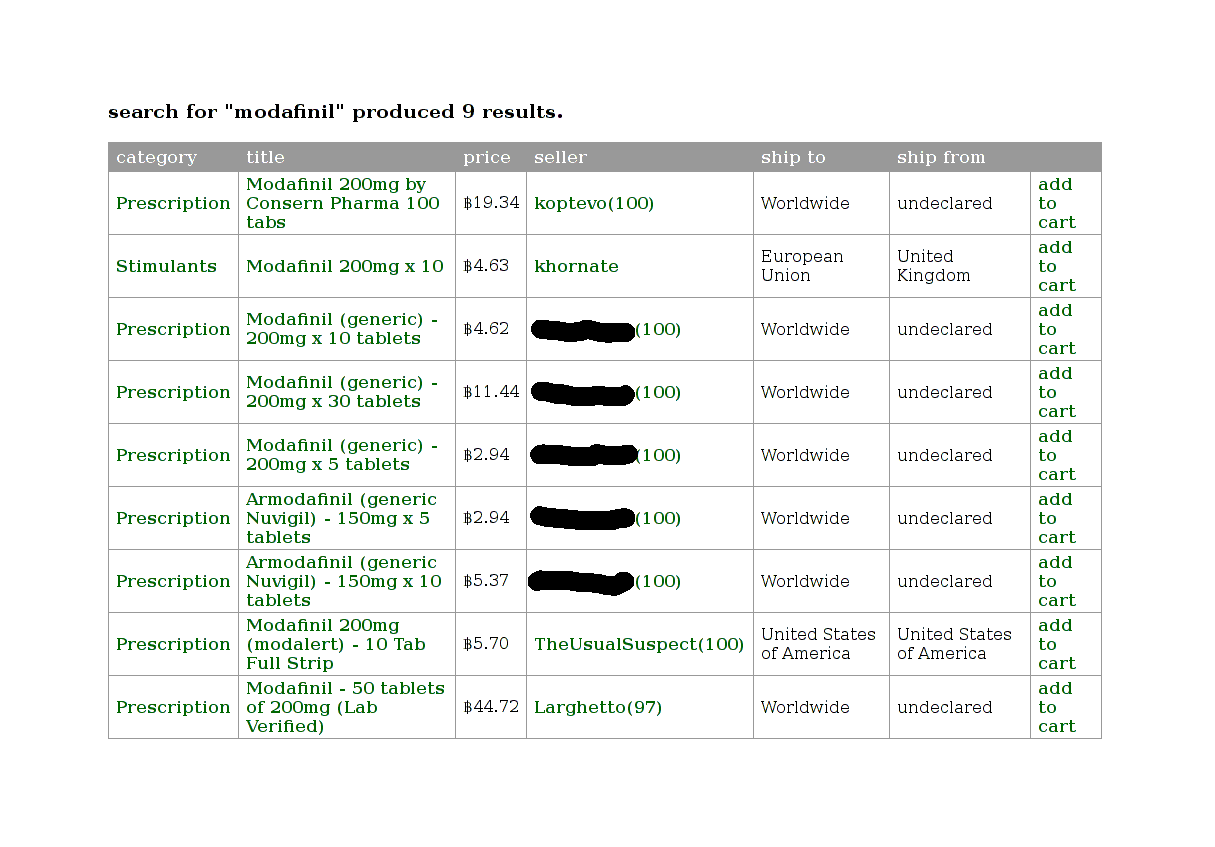

A final example: I search for modafinil:

Search results for the query ‘modafinil’

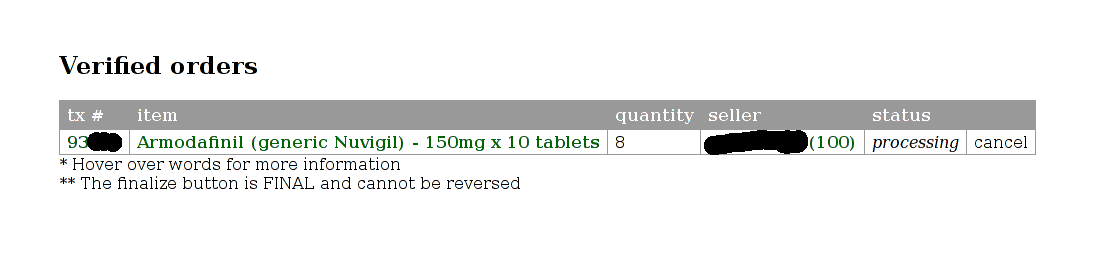

I finally decide to order 80x150mg armodafinil from a French seller (not so cheap as before):

Cart report

2 weeks later, it arrived in heavily folded paper inside this envelope:

a message from France

Containing the agreed-upon purchase:

the booty

LSD Case Study

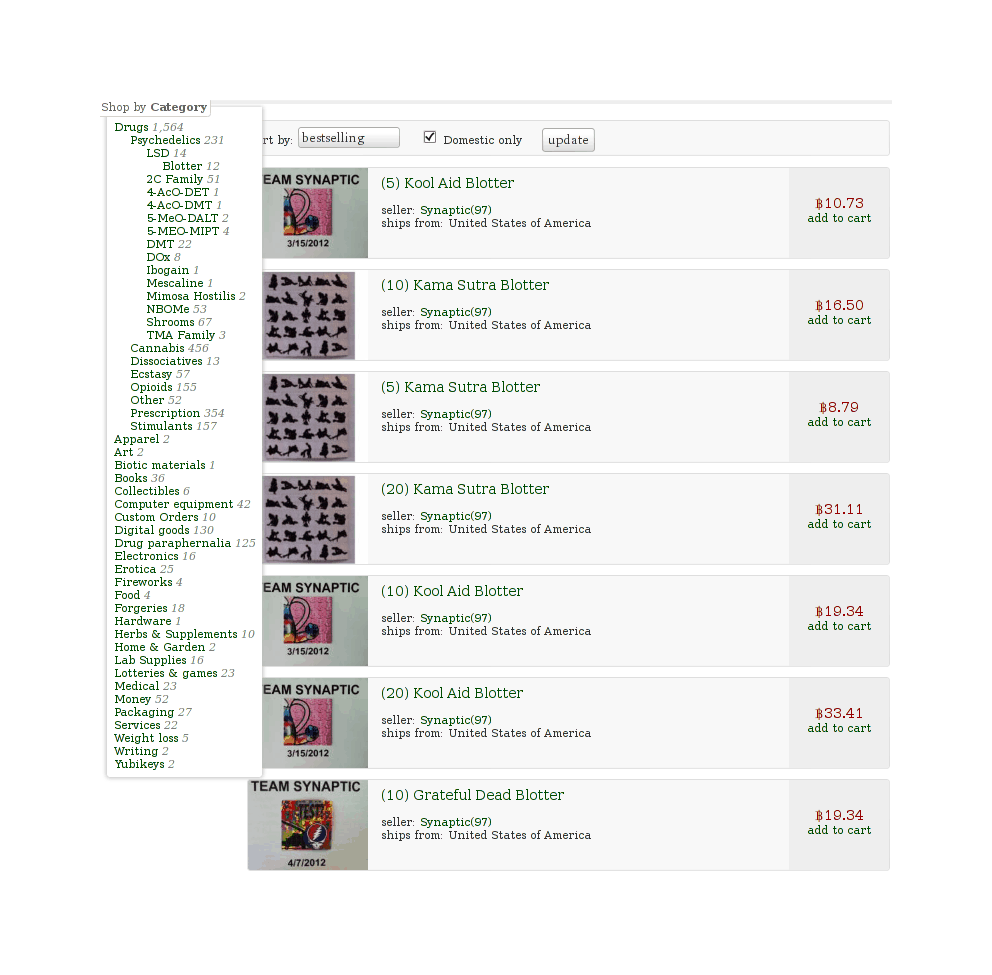

With Adderall & modafinil, the seller choices were restricted enough and scams rare enough that I did not need to think hard about the process. When I became interested in running my LSD microdosing self-experiment, I looked at the LSD sellers, and this ease vanished; scammers were an acknowledged plague, and there was a bewildering array of options:

The first page of LSD listings on SR in September 2012

Where does one start? I decided to turn my shopping frustrations into a case study of a systematic approach to evaluating the available information (but mostly an excuse to collect some unusual data and apply some statistical reasoning).

Seller Table

Background reading: “Official discussion thread of current LSD vendors”, “The Avengers LSD Vendors Review”, & “Collective Acid Database”.

This table of blotter listings <₿12 which ship to USA was compiled 2012-09-03 from SR search results for “LSD”. Note that the table is now entirely obsolete, but I believe the overall appearance is representative of the SR LSD marketplace.

Listing |

# |

μg |

₿ |

S&H |

μg/₿ |

Transit |

User |

Age (days) |

FE |

Feedback |

Weighted μg/₿ |

Threads |

LSD reviews |

Forum hits |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

“Matrix™” |

5 |

250 |

11.67 |

1.75 |

93 |

international |

360 |

yes? |

300(98.7%) |

9021 |

many |

many |

||

5 |

120 |

6.99 |

0.42 |

81 |

international |

360 |

no?22 |

300(93.7%) |

74 |

>6 |

18023 |

|||

2 |

110 |

2.96 |

0.34 |

7024 |

international |

360 |

yes |

300(97.3%) |

67 |

N/A |

2 |

6025 |

||

Synaptic26 |

||||||||||||||

5 |

200 |

7.45 |

0.58 |

125 |

international |

360 |

yes |

300(95.1%) |

115 |

>18 |

90 |

|||

“Trip” |

5 |

150 |

8.02 |

0 |

94 |

domestic |

120 |

no |

173(93.4%) |

84 |

0 |

2027 |

||

2 |

250 |

4.12 |

1.42 |

104 |

international |

120 |

no? |

300(99.9%) |

103 |

many |

many28 |

|||

5 |

250 |

10.21 |

1.42 |

107 |

international |

120 |

no? |

300(99.9%) |

106 |

many |

many |

|||

5 |

? |

6.99 |

0 |

72 |

domestic |

60 |

no |

68(99.1%) |

67 |

2 |

2229 |

|||

1 |

125 |

0.83 |

0.32 |

143 |

international |

60 |

yes? |

127(97.6%) |

134 |

? |

11 |

|||

10 |

125 |

7.19 |

0.49 |

163 |

international |

nipplesuckcanuck |

60 |

yes? |

127(97.6%) |

153 |

3 |

11 |

||

“Shiva” |

2 |

100 |

2.18 |

0.18 |

85 |

domestic |

30 |

no |

76(100%) |

82 |

N/A |

0 |

930 |

|

5 |

150 |

7.53 |

0 |

100 |

international |

30 |

no |

10(100%) |

74 |

N/A |

0 |

1 |

||

5 |

100 |

7.36 |

0.59 |

63 |

domestic |

24 |

no |

28(100%) |

57 |

0 |

9 |

|||

5 |

150 |

4.28 |

0 |

175 |

domestic |

10 |

no |

0(?%) |

88 |

N/A |

0 |

331 |

||

5 |

150? |

6.41 |

0.29 |

112 |

domestic |

4 |

? |

0(?%) |

56 |

0 |

3 |

|||

“Koi Fish” |

1 |

250 |

2.51 |

0.6 |

80 |

international |

7 |

yes |

0(0%) |

40 |

N/A |

0 |

0 |

An anonymous email provided me in November 201214ya with a catalogue from a Dutch bulk seller who sells LSD (among other things); their listed prices serve as a useful comparison:

Blotter brand |

Dose (μg) |

Unit-count |

unit-price (€) |

min. total cost (€) |

min. μg/€ |

|---|---|---|---|---|---|

Fat & Freddy’s |

200-250 |

100-1000 |

4.75 |

475 |

42.1 |

Fat & Freddy’s |

200-250 |

2000-4000 |

4.25 |

8500 |

47 |

Fat & Freddy’s |

200-250 |

5000-9000 |

3.90 |

19500 |

51.3 |

Fat & Freddy’s |

200-250 |

10000+ |

“negotiable” |

? |

? |

Ganesha |

100-120 |

100-1000 |

2.50 |

250 |

40 |

Ganesha |

100-120 |

2000-4000 |

2.25 |

4500 |

44.4 |

Ganesha |

100-120 |

5000-9000 |

1.70 |

8500 |

58.8 |

Ganesha |

100-120 |

10000+ |

“negotiable” |

? |

? |

Hofmann bicycle man |

100-120 |

100-1000 |

2.50 |

250 |

40 |

Hofmann bicycle man |

100-120 |

2000-4000 |

2.25 |

4500 |

44.4 |

Hofmann bicycle man |

100-120 |

5000-9000 |

1.70 |

8500 |

58.8 |

Hofmann bicycle man |

100-120 |

10000+ |

“negotiable” |

? |

? |

To convert ₿ to € (as of 2012-09-03), we multiply by 8.3. So for comparison, the top Dutch blotter was 58.8μg/€, and the top unweighted SR blotter was 163μg/₿; in €, the SR becomes 163μg/8.3₿ or 19.64μg/€, indicating that a small SR purchase with S&H will have an unit-price 3x of a large Dutch purchase minus S&H.

A factor of 3 seems pretty reasonable, given the very large markups along the LSD supply-chain. 200323ya trial testimony32 for the American LSD chemist William Leonard Pickard stated that his wholesale customers paid him ~$0.3 per 100μg, or (as of 2012-09-03) 0.0286₿ per 100μg, or 3497μg/₿. (A stark contrast to 163μg/₿!)

Description

Some general observations on this table of a subset of LSD sellers:

There’s a striking number of new sellers: listings from ‘young’ accounts (<=2 months old) make up more than half the table. I’ve seen many complaints about a lack of US sellers but it seems the market is responding.

There are dismayingly few LSD reviews on the forums for any seller except EnterTheMatrix; this seems to be partially due to the presence of many sellers not specializing in LSD.

Long-term feedback below 95% is a warning sign. Of the 3 ‘old’ sellers with ~95% or less feedback (aakoven, juergen200125ya, & lonely kamel), all 3 have plenty of bad feedback on the forums. If it were just one that had both bad feedback and bad forum comments, it might be some sort of astroturfing or ‘hating’ (as aakoven pre-emptively accuses his bad feedback rating), but when all 3 have both bad forums and feedback ratings? Makes one wonder… Nor is that the ‘cost of doing business’ for very old seller accounts, since we see that the similarly old EnterTheMatrix33 & PremiumDutch ratings are solidly better.

Since their μg/₿ are not stellar (save juergen2001’s), it’s not clear why anyone would buy from them.

Some of the new sellers seem to have a lot of feedback (eg. No FE ever or nipplesuckcanuck), but looking at their feedback, we see a great deal of early finalization! This renders them pretty suspect. And of course, the 3 youngest sellers have no feedback at all. This is a problem because scammers are a serious problem with LSD sellers; a quick read of forum threads lists 5 scammers over the past 3 months: Kat, Gar, Bloomingcolor, Fractaldelic, & DiMensionalTraveler.

The range of μg/₿ is interesting: a full order of magnitude is represented, from the low of 63μg/₿ to 175μg/₿.

Perhaps surprisingly, this range doesn’t go away when I try to adjust for risk based on reviews: now the full range is 40μg/₿ (aciddotcom) to 153μg/₿ (nipplesuckcanuck).

Analysis

Quantitative

In my modafinil article I discussed some basic statistical techniques for optimizing orders under uncertainty: one-shot ordering, repeated ordering with free learning, & repeated ordering with expensive learning.

In this case, it’s a single order, so one-short ordering it is. One-shot ordering simply counsels ordering from a mix of the cheapest and the safest seller—what maximizes one’s expected value (EV), which is just . The reward is easy: total dose divided by total cost. The risk is harder: the sellers do not conveniently volunteer how likely you are to be scammed.

The obvious way to quantify risk is to just take the feedback at face-value: a 97% rating says I am taking a 3% chance I will be screwed over. Multiply that by the reward, sort to find the largest EV, and we’re done.

An objection: “Are you seriously saying that a seller with 1 bad review out of 100 is equally trustworthy as a seller with 3 bad reviews out of 300, and that both of them are less trustworthy than a vendor with 0 bad reviews out of 10?” It does seem intuitive that the 300 guy’s 99% is more reliable than the 100 guy’s 99%; the 10 guy may have a perfect 100% now, but could easily wind up with something much lower after he’s sold 100 or 300 things, and we would rather not be one of the buyers who causes those shifts downward.

So. Suppose we pretended reviews were like polling or surveys which are drawing votes from a population with an unknown number of bad apples. We could call it a draw from a binomial distribution. We’re not interested in the optimistic question of “how good could these sellers turn out to be?”, but rather we are interested in finding out how bad these sellers might truly be. What’s the worst plausible vendor future rating given their existing ratings? We can ask for a confidence interval and look at the lower bound. (Lower bounds remind us no vendor is 100% trustworthy, and indeed, pace the hope function, the higher their rating the greater their incentive to require FEs and disappear with one last giant haul; the actual SR feedback system seems to use some sort of weighted average.) This gives us the pessimistic percentage of feedback which we can then interpret as the risk that we will be one of those bad feedbacks, and then we can finally do the simple expected-value calculation of “μg/₿ times probability of being happy”. What are the results? The numbers were calculated as follows:

# Frequentist analysis:

# https://en.wikipedia.org/wiki/Binomial_proportion_confidence_interval#Clopper-Pearson_interval

y <- function(ugbtc,n,pct) {((binom.test(round((pct/100)*n),n,conf.level=0.90))$conf.int):1 * ugbtc}

# Binomial CI doesn't work on 0 data; what do we do? Punt with the age-old 50%/coin-flip/equal-indifference

# Why 90% CIs? Fake feedback skews the stats up and down, so we might as well get narrower intervals...

c(y(63,28,100), y(70,300,97.3), y(72,68,99.1), 90*0.5, y(81,300,93.7), y(85,76,100), y(93,300,98.7),

y(94,173,93.4), y(100,10,100), 112*0.5, y(125,300,95.1), y(143 127,97.6), y(163,127,97.6), 175*0.5)

[1] 56.60766 66.66799 67.11326 45.00000 73.58456 81.71468 90.18671

[8] 84.31314 74.11344 56.00000 115.50641 134.43170 153.23333 87.50000

# Question: what if we use a Bayesian Jeffreys interval?

# https://en.wikipedia.org/wiki/Binomial_proportion_confidence_interval#Jeffreys_interval

install.packages("MKmisc")

library(MKmisc)

y <- function(ugbtc,n,percent) {binomCI(x=round((percent/100)*n),n=n,conf.level=0.90,

method ="jeffreys")$CI:1 * ugbtc }

c(y(63,28,100), y(70,300,97.3), y(72,68,99.1), 90*0.5, y(81,300,93.7), y(85,76,100), y(93,300,98.7),

y(94,173,93.4), y(100,10,100), 112*0.5, y(125,300,95.1), y(143,127,97.6), y(163,127,97.6), 175*0.5)

[1] 58.85933 66.81522 67.96488 45.00000 73.74114 82.88563 90.39917

[8] 84.64024 82.92269 56.00000 115.75319 135.22059 154.13256 87.50000

# Answer: it's almost identical.

# If Bayesian and frequentist methods differed much, one would be wrong and no one would use it!

# let's look in further, how *exactly* do the ug/₿ ratings differ?

binom <- c(56.60766, 66.66799, 67.11326, 45.00000, 73.58456, 81.71468, 90.18671, 84.31314, 74.11344,

56.00000, 115.50641, 134.43170, 153.23333, 87.50000)

jeffreys <- c(58.85933, 66.81522, 67.96488, 45.00000, 73.74114, 82.88563, 90.39917, 84.64024,

82.92269, 56.00000, 115.75319, 135.22059, 154.13256, 87.50000)

mapply(function(x,y) round((x-y)/y * 100,digits=2), binom, jeffreys)

# [1] -3.83 -0.22 -1.25 0.00 -0.21 -1.41 -0.24 -0.39 -10.62 0.00

# [11] -0.21 -0.58 -0.58 0.00

## in 1 case, for Machine Maid, the ug/₿ estimates differ by 10.62%, which is interesting(This demonstrates, incidentally, that feedback ratings don’t start yielding very high assurance until a surprisingly large number of reviews have been made.)

Now we have risk factored in from just the quantitative data of the feedback amount & percentage. But we must be more subjective with the other factors.

Qualitative

We have to look at more qualitative information and start comparing & ranking possibilities. There are a few criteria that one should value; in roughly descending order of importance:

old > new

high weighted-μg/₿

many reviews on SR & forums

no FE > FE

domestic > international

has feedback thread

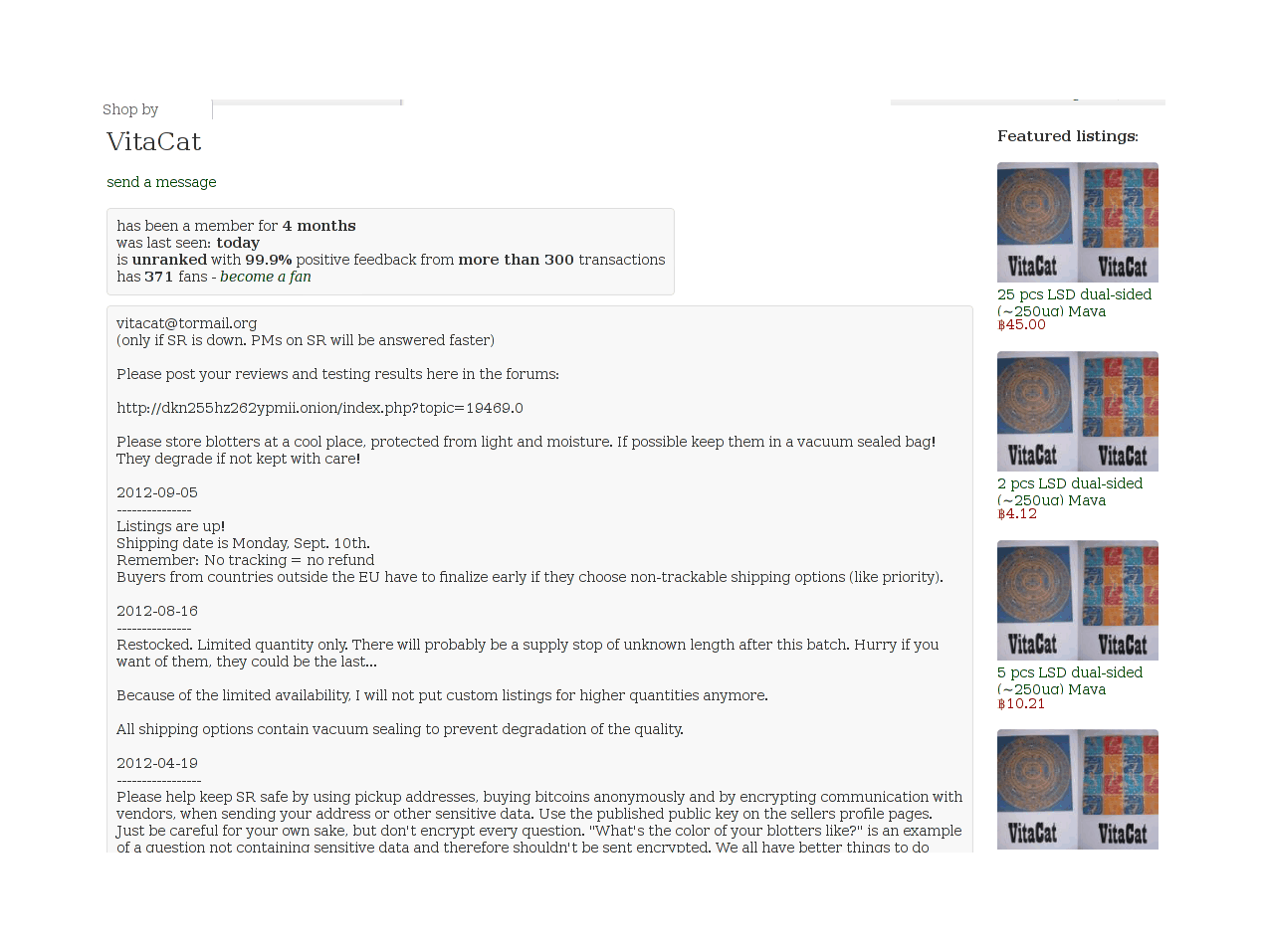

For a first cut, we look at all items meeting #2, where a good cut off seems to be weighted-μg/₿>90; this is just EnterTheMatrix, juergen200125ya, VitaCat, and nipplesuckcanuck. A second cut is 200125ya for requiring FE;

So we’re down to VitaCat and EnterTheMatrix. On most of the listed metrics, they are about equal—EnterTheMatrix seems to have an edge in feedback due to greater volume, but it’s hard to say for sure. Going with VitaCat promises to save a little bit of money since his weighted-μg/₿ is ~10 greater. So our analysis winds up with the conclusion of ordering from VitaCat, who has a reasonable-looking profile:

Homepage of the VitaCat LSD seller on Silk Road

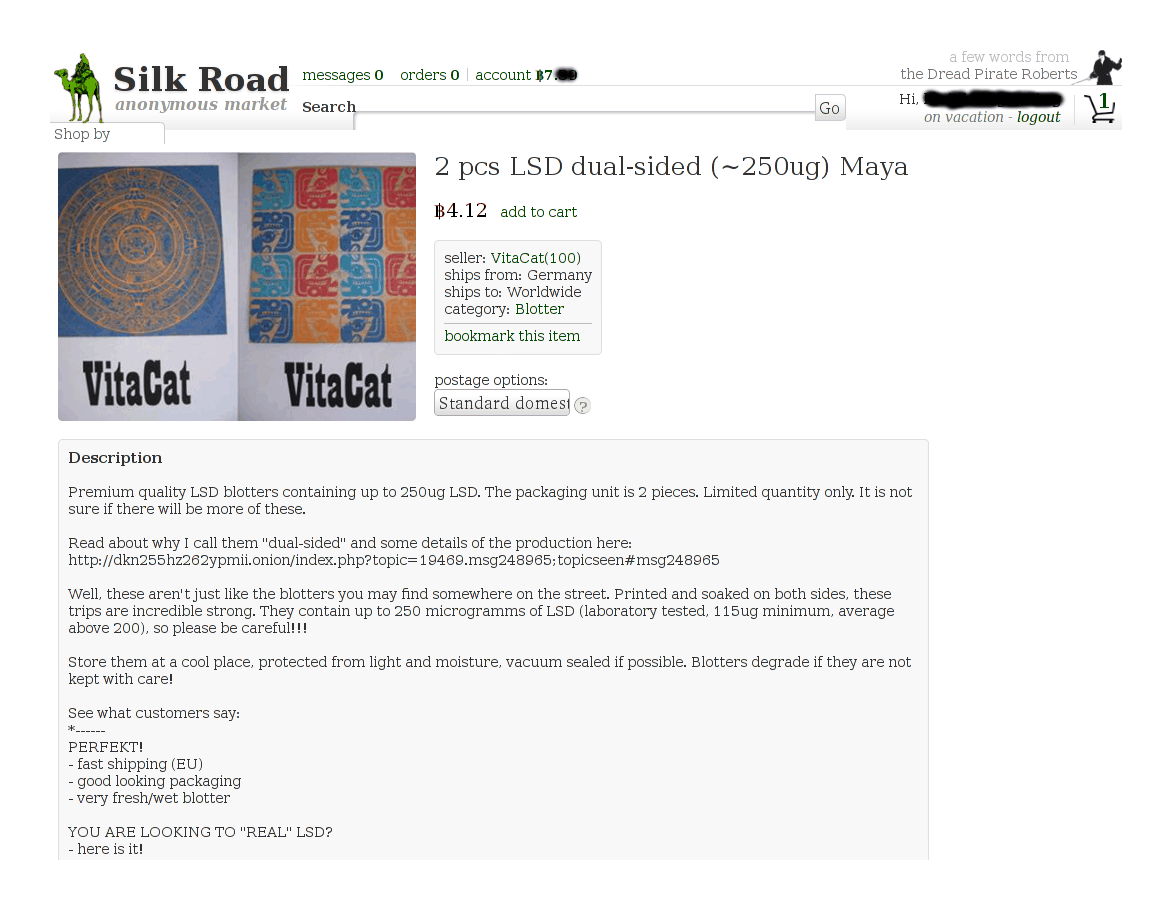

And whose Maya listing looks perfectly acceptable:

VitaCat’s 250μg LSD blotter listing

Ordering

Was this the right choice? I have no idea. The best I can say is that checking the SR forums in December 201214ya, by which time any September order would have been delivered or not, there were no reports of that seller being a scammer or having engaged in a rip-and-run, while some of the lower-ranked sellers seem to have disappeared.

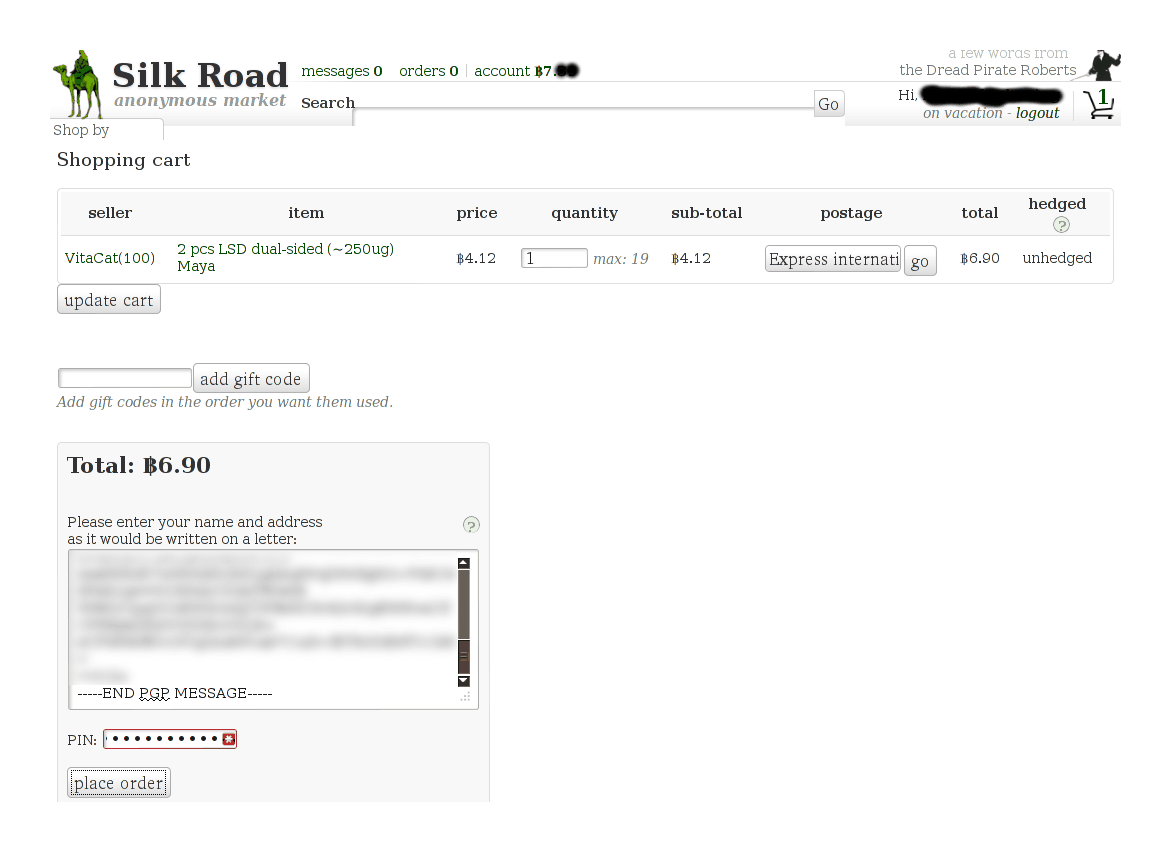

I bought the 2-dose item since I couldn’t afford the 5-dose one. (It would’ve been useful but I wasn’t sure I wanted to sink in that much money, 2 doses should suffice, and it was highly likely that he would sell out before I had converted any more money into Bitcoin—as indeed he did sell out.) So instead I paid extra for tracking. Ordering was like any other SR order; I filled out the cart:

SR1 cart showing my order from VitaCat

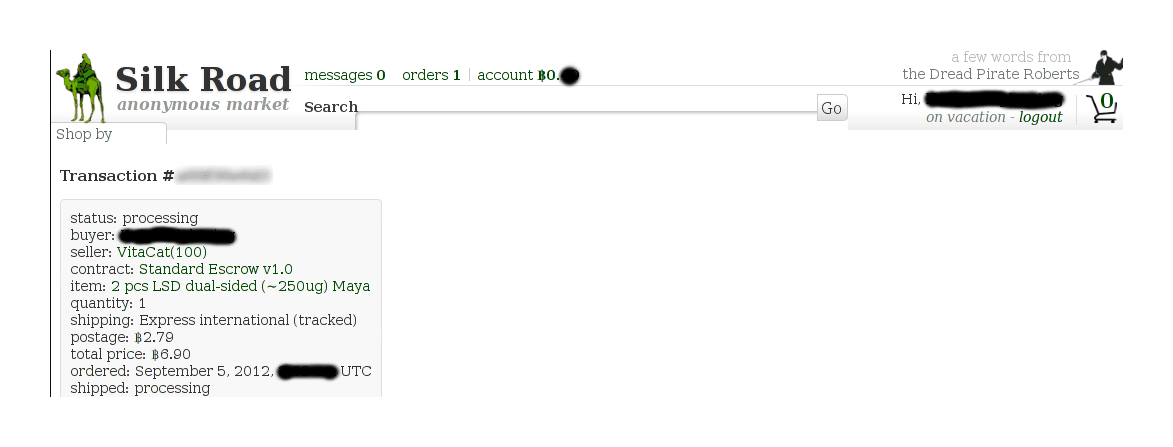

Was able to check the details to make sure everything was right:

Order details

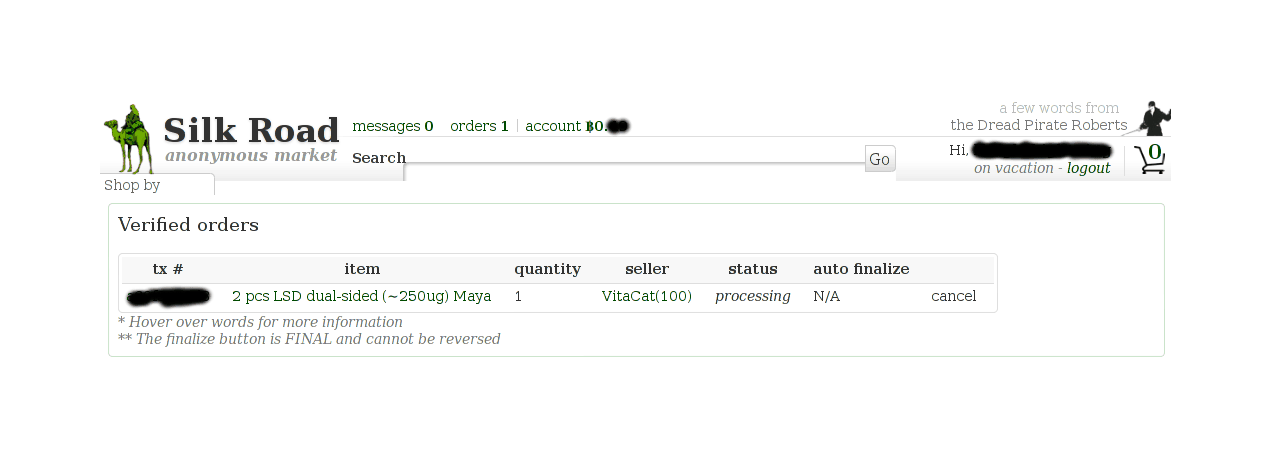

Waited impatiently while it was processing to see if he would accept my overseas order:

Order status page showing order has been marked as ‘processing’

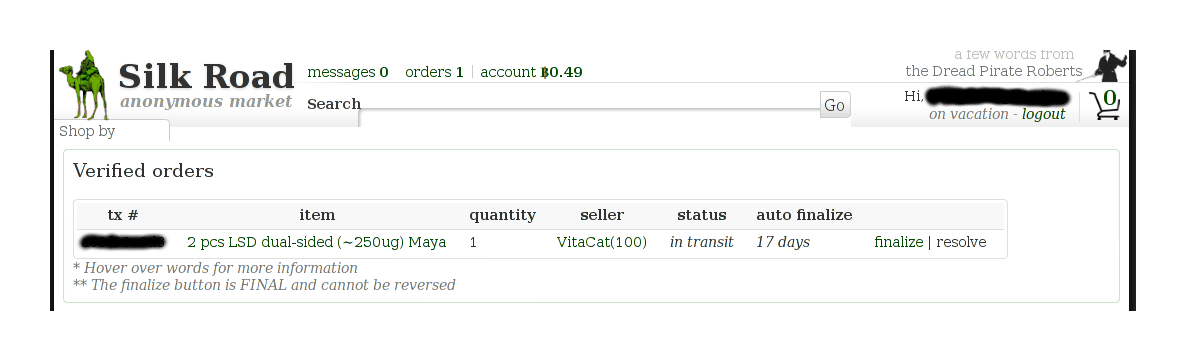

And when he did, sat back and waited:

Order status page: in transit

It came without any issue:

Photograph of envelope containing my LSD order from SR1’s VitaCat

Packaging

Because it’s just paper imbued with a tiny dose of the chemical, it’s easy to mail LSD around without issue. If anything, the packaging was a bit too clever, masquerading as ordinary business mail with a coupon:

Decoy letter

The attached “coupon” or 2 tabs (in a sealed plastic coating, so the fragile LSD doesn’t degrade) was smaller than I had expected:

2 250μg doses of LSD on “Mayan” blotter paper, shipped from Germany in a sealed plastic sheet

VoI: Ehrlich Test

We have one last question about ordering: should we buy an “Ehrlich test”?

An Ehrlich test is a reagant for indole alkaloids, a category which includes psychedelics like LSD & psilocybin. As such, it can be used as a kind of quality check. However, while any LSD product will probably trigger a positive, so will other chemicals; and the test itself may simply be wrong.

Is an Ehrlich test worth buying? This sounds like a classic Value of Information problem.

The only SR listing for an Ehrlich test is a Synaptic listing (a seller who I have already criticized for shoddy security practice) which both costs >$40 and has a highly negative review! Googling on the open web leads quickly to eztestkits selling for £4.99, which with S&H is probably $10-15, and Avalon Magic Plants for a similar price. Synaptic’s listing is clearly a fool’s buy (and I heard later he was banned), but the latter two may not be.

The fundamental question of a VoI analysis is: how would this information change your actions? If the test being positive rather than negative would not lead you to do anything differently, then the information has no (direct) value.

This leads to a quick answer: if I tested a VitaCat dose (destroying >$20 of LSD) and it was negative, would I throw the rest out? No. I would be too curious, and I would have spent too much to tranquilly chuck it based on one test which I do not trust as compared against a very reputable seller. (I would be too curious since I do not plan to order again.) Therefore, the VoI is zero; and a value of zero does not justify spending the money on buying a kit and wasting LSD and time. I would just find out the hard way.

Finis

There is no proof of all of the above—anything here could have been faked with Photoshop or simply reused (perhaps I have a legitimate Adderall prescription). Take it for what it is and see whether it convinces you: argument screens off authority.

But looking back, I have been lucky: from reading the forums, it’s clear that there are scammers on SR34, and shipments do get lost in the mail or seized or otherwise not delivered. (I do not expect any legal problems; law enforcement always go after the sellers, to achieve maximum impact, and SR presents both technical and jurisdictional problems for law enforcement.) This is inherent to the idea of an anonymous marketplace, but the system worked for me. SR describes it well in one of his messages: