The fastest growing tech companies are often Bad. So many tech darlings end up breaking the law, creating a monstrous culture, or financially imploding, that it’s surprising to find one that hasn’t yet.

This is not an accident. It’s an inevitability. Not all Bad tech companies are successful, but almost all successful tech companies are Bad.

Successful tech companies are Bad because to become one, you have to take the Fastest Survivable Path.

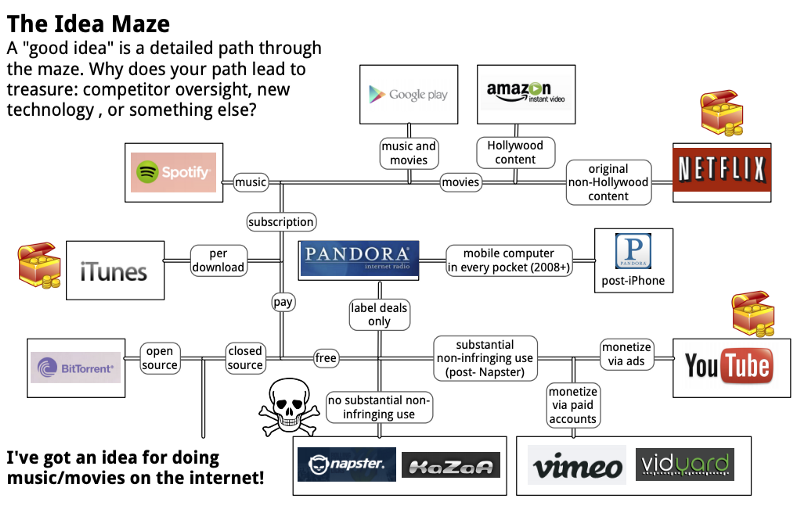

The Idea Maze

The Idea Maze maps all your startup’s possible strategies. Every decision you make, deliberate or accidental, forks your path through the maze.

There are many good examples of the maze, but here’s Balaji Srinivasan’s original illustration:

Entering the maze isn’t hard — any idea gets you in — but finding your way through is. Different products solve the same problem, strategies have interdependencies, and it’s impossible to map entirely.

You can’t know in advance whether your path leads to success. If you could, successful paths would become overcompetitive and change the maze. There is an idea observer effect.

What you can know in advance, is that any startup that survives the maze found the Fastest Survivable Path.

Ex Ante

Since you can’t know up front which path will lead to success, without competition, you should simply pick the least risky path. If no-one else is navigating the maze, take as long as you need. Just don’t die.

But competition changes the maze.

If someone builds Spotify before you, you can’t build Spotify. Often paths are single use — owning exclusive rights to distribute music, for example.

A competitor taking a faster, riskier path can turn your safer path into a literal dead end. A definitely legal version of Airbnb might have worked, but the possibly illegal Airbnb took that path away.

With competition, the path with the highest probability of success is the path with the highest probability of succeeding first assuming your competitors pick the other paths.

Fastest Survivable Path

Faster paths are usually riskier, and being Bad is usually risky. You can operate in a legal grey area, you can ignore a toxic culture, you can figure out the business model later. And you may get through the maze faster. But you may die along the way.

With few competitors in the maze, it’s unlikely that high risk paths have a survivor. If a competitor takes a path with a 1% survival rate, they almost certainly won’t make it.

But, the more competition there is, the riskier the winning survivor’s path is likely to be. If 100 competitors take paths with 1% survival rates, most of the time one will make it.

Because so few startups succeed, promising ideas inevitably attract lots of competition. That’s why startups that succeed are Bad. A reckless startup will almost always win, it’s just hard to know in advance which.

Winning startups operate in grey areas until they’re white, with a culture just bad enough not to kill them, and figure out the business model later. They take the fastest, riskiest path that actually works.

They are the survivors of the Fastest Survivable Path.

Ex post

Almost every company that searches for the Fastest Survivable Path will die. But some won’t. And they’re the companies that beat the maze.

That’s why it didn’t matter that Airbnb operated illegally, that Revolut mistreated employees, or that Tesla made a perpetual loss. Or why Uber did all three and can still IPO. They took the Fastest Survivable Path.

Ex ante, the path with the best odds is the path with the highest probability of being first assuming your competitors pick the others. But ex post, the only path that matters is the fastest anyone survives. And that selects out companies that trade being Good for being fast.

Founders will forever accidentally build Theranos, Zenefits, and Naspter. Because, for founders, being Good doesn’t pay if it’s not on the Fastest Survivable Path.

Thanks to the Entrepreneur First team for reading drafts of this. If you’d like to take the Fastest Survivable Path, start here.